With more than 500 responses in so far to The Bank On Yourself Fear Factors Challenge, you may be interested in knowing how your choices compare to the rest of America.

With more than 500 responses in so far to The Bank On Yourself Fear Factors Challenge, you may be interested in knowing how your choices compare to the rest of America.

Here is how the responses to each of our 10 survey questions have broken down. The percentages reveal which option our survey-takers find more scary!

You’ll see that snakes, blood, public nudity, eating fire-hot peppers, and even close proximity to a psychotic killer caused far fewer trembles than did the terrifying prospect of winding up in a serious financial jam.

Here’s what Americans find most scary…

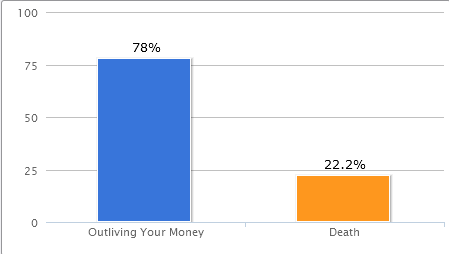

1. Which of the following is more frightful to you?

- 22.2% – Death

- 78% – Outliving Your Money

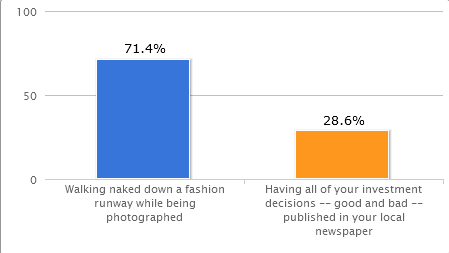

2. Which of the following is more frightful to you?

- 28.6% – Having all of your investment decisions — good and bad — published in your local newspaper

- 71.4% – Walking naked down a fashion runway while being photographed

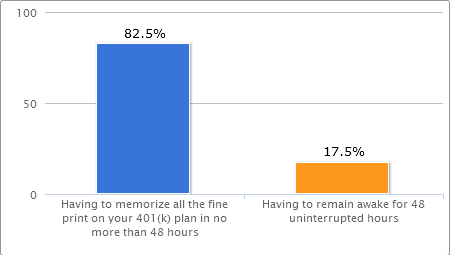

3. Which of the following is more frightful to you?

- 17.5% – Having to remain awake for 48 uninterrupted hours

- 82.5% – Having to memorize all the fine print on your 401(k) plan in no more than 48 hours

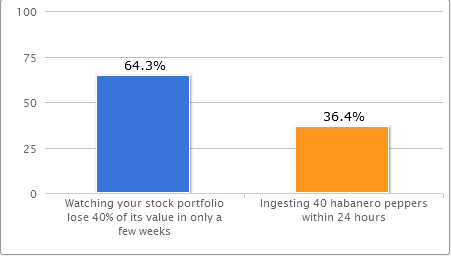

4. Which of the following is more frightful to you?

- 64.3% – Watching your stock portfolio lose 40% of its value in only a few weeks

- 36.4% – Ingesting 40 habanero peppers within 24 hours

The ultimate financial security blanket

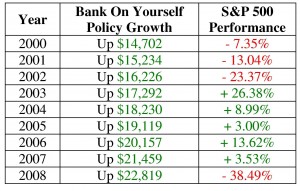

Did you know that the Bank On Yourself wealth-building method has NEVER had a losing year? Used by Walt Disney and J.C. Penney, it has stood the test of time for more than 160 years.

To find out how you can grow your nest-egg safely and predictably, even when stocks real estate and other investments tumble… and how much money you could have – GUARANTEED – on the day you plan to retire, request your FREE no-obligation Analysis and Recommendations now.

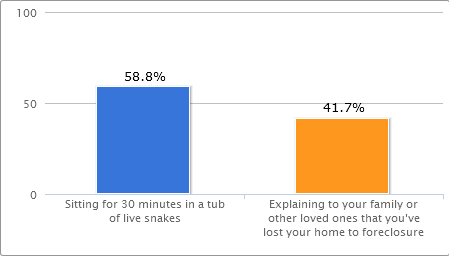

5. Which of the following is more frightful to you?

- 58.8% – Sitting for 30 minutes in a tub of live snakes

- 41.7% – Explaining to your family or other loved ones that you’ve lost your home to foreclosure

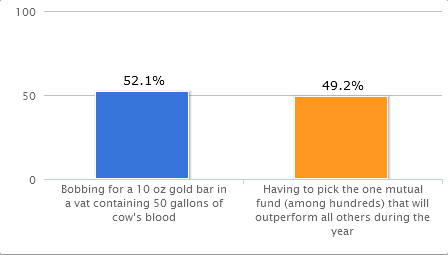

6. Which of the following is more frightful to you?

- 49.2% – Having to pick the one mutual fund (among hundreds) that will outperform all others during the year

- 52.1% – Bobbing for a 10 oz gold bar in a vat containing 50 gallons of cow’s blood

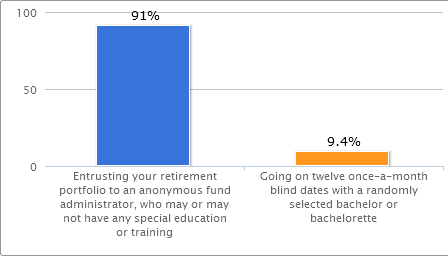

7. Which of the following is more frightful to you?

- 9.4% – Going on twelve once-a-month blind dates with a randomly selected bachelor or bachelorette

- 91% – Entrusting your retirement portfolio to an anonymous fund administrator, who may or may not have any special education or training

Editors Note: Although 9 out of 10 Americans fear entrusting their retirement to an incompetent administrator, millions of Americans may unknowingly be doing exactly that right now! Read our shocking exposé and learn the facts!

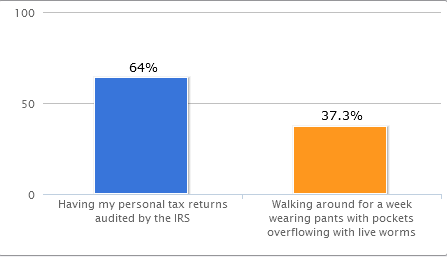

8. Which of the following is more frightful to you?

- 64% – Having my personal tax returns audited by the IRS

- 37.3% -Walking around for a week wearing pants with pockets overflowing with live worms

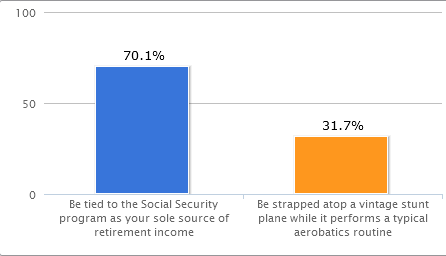

9. Which of the following is more frightful to you?

- 31.7% – Be strapped atop a vintage stunt plane while it performs a typical aerobatics routine

- 70.% – Be tied to the Social Security program as your sole source of retirement income

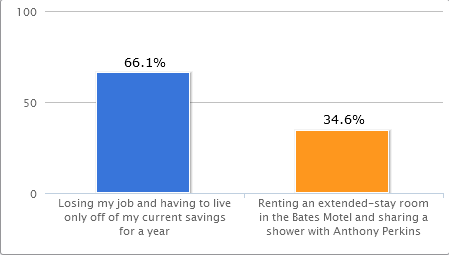

10. Which of the following is more frightful to you?

- 66.1% – Losing my job and having to live only off of my current savings for a year

- 34.6% -Renting an extended-stay room in the Bates Motel and sharing a shower with Anthony Perkins

Were you surprised by any of your responses?

These results are a sad commentary on the financial condition and current state of mind of so many of our family members, friends, neighbors and colleagues.

The definition of insanity is doing the same things in the same way and hoping for different results. So, if you’re ready to find a better way to save and invest for your financial future that gives you peace of mind and lifetime financial security, check out the Bank On Yourself method.

To find out how much brighter your financial picture could be if you added Bank On Yourself to your financial plan, request your free, no-obligation Analysis now, while it’s fresh on your mind!