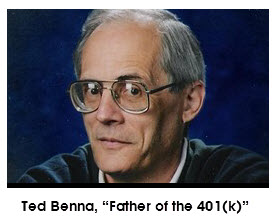

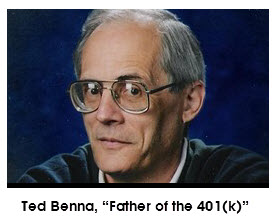

Ted Benna is known as the “Father of the 401(k).” In the late ‘70’s, he worked as a consultant to business owners whose main agenda was “How can I get the biggest tax break, and give the least to my employees, legally?”

Tax nerd that he was, Benna discovered an obscure part of the tax code – section 401(k). Voila! By 2012, nearly 75% of all company pension plans had disappeared!

What does Mr. Benna say about his beautiful 401(k) baby today?

If I were starting over from scratch today with what we know, I’d blow up the existing structure and start over!”1

Uh oh.

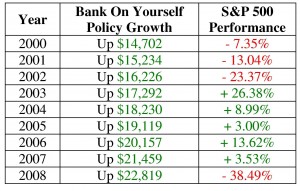

Per the US Senate Committee on Health, Education, Labor, & Pensions: “After a lifetime of hard work, many seniors will find themselves forced to choose between putting food on the table and buying their medication.” The U.S. Census Bureau says the average value of 401(k) accounts of pre-retirees between 55 and 64 is only $170,645; the average value of their IRAs is only $147,345. And half of all those close to retirement age have less than $50,000 in these plans.

Something went horribly wrong. Actually, several things went horribly wrong, not only with 401(k)’s but also their kissing cousins: IRA’s, Roth Plans, 403(b)’s, SEP-IRA’s and so on.

And the problems with these government-controlled plans are in these five key areas:

[Read more…] “Are you putting your retirement savings in prison?”