401K plans are the most common option used by Americans to grow a nest-egg for retirement. However, they come with numerous drawbacks, 401K withdrawal rules and restrictions which are spelled out below. We’ll also look at how 401Ks compare with using Bank On Yourself as a 401K alternative, when flexibility, control, tax advantages and guarantees are important to you:

1. Do you control your money in the plan?

Bank On Yourself

Unlike trying to take a 401K withdrawal, the Bank On Yourself strategy gives you complete control over your equity in the policy. You can borrow your equity when you want, for whatever you want, and you don’t have to sell your assets to do so.

A very unique feature of this kind of policy is that when you borrow your equity, it could continue growing as though you never touched a dime of it. In addition, you receive the same guaranteed annual increase regardless of whether you have a policy loan, and any dividends you may receive are not affected by policy loans (if your policy is administered by one of the handful of companies that offer this feature). In addition, you determine your own loan repayment schedule.

Using what our research has shown is the best 401K alternative – the Bank On Yourself method – one couple was able to have a total of $2.31 million over thirty-three years of retirement, primarily by redirecting money their employers weren’t matching from their 401K plans. That happened even though they used their policies over the years to finance new cars every four years and for foreign travel.

No two Bank On Yourself plans are the same. Yours would be custom-tailored to your unique long-term and short-term financial goals and dreams. To find out what your bottom-line numbers and results would be if you added Bank On Yourself to your financial plan, request your FREE no-obligation Analysis now.

401K or Qualified Plan

If you need access to your money in a 401K, you may be able to borrow money from it up to certain limits.

This typically involves liquidating assets, and you’ll stop earning interest and investment income on those funds.

You’re typically required to pay your loans back within 5 years, or the outstanding balance becomes taxable and you also have to pay a 10% penalty.

If you invest in a 401K, letting your employer choose your investments can easily deprive you of $500,000 or more of your hard-earned savings!

Read this shocking expose’ today and find out what you can do to protect yourself!

One study calculated that a 35-year-old with a $20,000 plan balance who takes out two loans in fifteen years ends up with about $38,000 less at age 65 than someone who never borrows, even if the loans are repaid without penalty (“Tempted to Borrow from a 401K Account” – New York Times).

TRAP: If you lose your job or leave your company for any reason (and you haven’t reached age 59-1/2), in most cases you’re required to pay any loans back – in full – with interest in 30 to 60 days, or you’ll have to pay income taxes on it, plus a 10% penalty.

2. Can you take income from the plan when and how you want?

Bank On Yourself

You can take income from a policy used for the Bank On Yourself method when and how you wish. There are no penalties for early, late or no withdrawals, and no minimum withdrawal requirements.

401K or Qualified Plan

The 401K withdrawal rules are very restrictive: There are penalties for taking distributions before you’re a certain age, and you’re required to start taking distributions when you’re 72, whether you want or need to.

3. Is your growth guaranteed and predictable?

Bank On Yourself

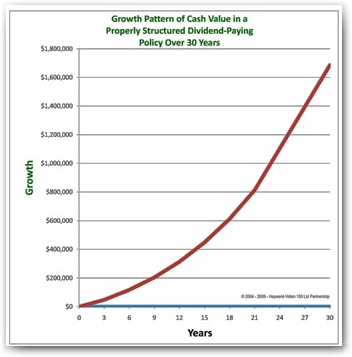

Your growth in a Bank On Yourself-type policy is both predictable and guaranteed. You receive a guaranteed annual increase, plus you have the potential for dividends, which, while not guaranteed, have been paid every single year for more than 100 years by the companies used by Bank On Yourself Professionals.

You’ll know the guaranteed value of your plan on the day you want to tap into it…and at every point along the way!

You can get a FREE analysis here that will show you how much your financial picture could improve if you added Bank On Yourself to your financial plan, along with a referral to a Bank On Yourself Professional, who is a life insurance agent with advanced training in this method.

401K or Qualified Plan

If your money is invested in the market, you could lose some or all of your money and have no way of predicting the value of your plan when you hope to tap into it.

Here’s a more detailed comparison of how Bank On Yourself compares to investing in the stock market.

4. What are the tax consequences?

Get instant access to the FREE 18-page Special Report, The Ultimate Wealth-Building and Retirement Strategy, plus timely briefings and solutions to critical news and events that may impact your money and finances.

Bank On Yourself

It’s possible to take retirement income without taxes due, under current tax laws. This is accomplished through a combination of dividend withdrawals and loans against your cash value, and making sure the policy does not lapse.

401K or Qualified Plan

Withdrawals from traditional 401K’s and qualified plans (other than Roth-type plans) are taxable. If tax rates increase in the future, as most experts believe they will, and you are successful in growing your nest-egg, you’ll end up paying higher taxes on a larger number.

MYTH: Many people believe they’ll come out ahead tax-wise by deferring taxes, however, deferring taxes could actually result in your paying much more tax – and that’s assuming the tax rates don’t increase at all.

Get instant access to the FREE 18-page Special Report, The Ultimate Wealth-Building and Retirement Strategy, plus timely briefings and solutions to critical news and events that may impact your money and finances.