Yep – I got charged an annual interest rate of 1,693% on a card I don’t even run a balance on! This will spook the living daylights out of you, so keep reading and find out how to make sure this doesn’t happen to you!

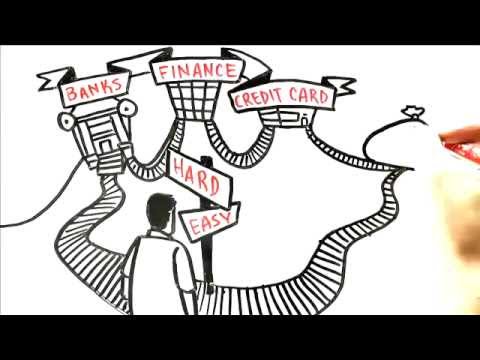

The Bank On Yourself Method Lets You Bypass Banks Altogether

The Bank On Yourself method lets you have access to the money you need, when and for whatever you need it. There are no applications to fill out and no qualifying.

You can pay your loans back on your own terms and you don’t have to worry about late fees, collections calls if you’re late or you miss some payments.

Check out our helpful Consumers’ Guide to Policy Loans here.

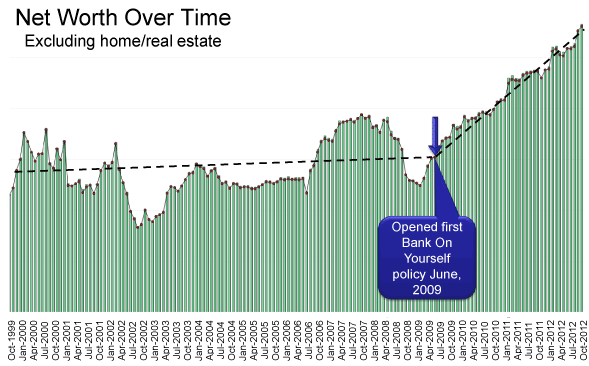

Did you know the typical family can potentially increase their lifetime wealth by hundreds of thousands of dollars by financing their major purchases through a Bank On Yourself plan? Find out how much bigger your nest egg could grow (without the risk or volatility of traditional investments) when you add the Bank On Yourself method to your financial plan. Just request your free Analysis here now (if you haven’t already).

Financing things through a Bank On Yourself plan even beats directly paying cash for things for several reasons.

You may not realize it, but you finance everything you buy, because you either pay interest when you finance or lease things… or you lose interest and investment income you could have had if you’d kept your money invested. Saving money in a Bank On Yourself policy first – and then using it to make major purchases – allows your money to continue growing as though you had never touched a dime of it.

I know of no other financial vehicle that gives you that same advantage, do you?

And not only do you get that advantage when you Bank On Yourself, it also lets you beat the banks at their own game, while providing you with a guaranteed, safe, predictable way to grow your nest egg.

Tale of a Savvy Consumer

Former teacher Ed Ingle and his wife decided to take a policy loan to do some home improvements soon after starting a Bank On Yourself policy, “Just to see how this whole loan thing worked. It was so easy that now we laugh at the idea of trying to understand the process. There is no process. It’s our money!”

Former teacher Ed Ingle and his wife decided to take a policy loan to do some home improvements soon after starting a Bank On Yourself policy, “Just to see how this whole loan thing worked. It was so easy that now we laugh at the idea of trying to understand the process. There is no process. It’s our money!”

In the first two years, Ed and his wife put the policy to work in several ways. They are putting their son through a private college through the plan. “No money goes to the bank,” Ed notes.

He purchased a car using the policy… and “no money goes to the bank!”

He also financed his wife’s graduate school through the plan. (“And no money goes to the bank!”)

Ed says he no longer worries when the stock market rises and falls. He no longer worries about the interest rates banks are charging. He’s in charge of his own finances from here on out. (And no money goes to the bank!)

An Interest Rate of Almost 1,700% Per Year?

My husband Larry and I haven’t run a balance on a card in years. We have a handful of cards we use for convenience and to get points and airline miles. We get our statements emailed to us, then pay them off in full online each month.

Last month, Larry realized we didn’t get the statement for the card we use for personal expenses. When he checked the account, he realized it was one day past the due date, so he immediately paid it. We discovered there would be a late fee and some interest due. The balance was around $3,500, so we figured the interest would be maybe a few bucks, right? Wrong!

A week later we got an email that floored us. It notified us of a $15 late fee, PLUS a $162.30 interest charge for being one day late with our payment! That’s 4.64% interest per day – 1,693% interest per year!

A whole page of fine print on the statement tried to explain all the “gotchas.” But it’s a fact that banks and finance companies are gonna get you one way or another. Why? Because they can.

Isn’t it time we used banks for our convenience, and not for theirs?

Of course, we now have this credit card set up for automatic payment in full each month. And if you have cards you pay in full each month, I suggest you do the same (if you haven’t already), to make sure this never happens to you.

You can fire your banker when you join the Bank On Yourself Revolution

It’s fast and easy to get started. Just request a free Analysis here, if you haven’t already, and find out how much more lifetime wealth you could have when you tell banks to go take a hike and become your own source of financing. But please do it today while it’s fresh on your mind!

Former teacher Ed Ingle and his wife decided to take a policy loan to do some home improvements soon after starting a Bank On Yourself policy, “Just to see how this whole loan thing worked. It was so easy that now we laugh at the idea of trying to understand the process. There is no process. It’s our money!”

Former teacher Ed Ingle and his wife decided to take a policy loan to do some home improvements soon after starting a Bank On Yourself policy, “Just to see how this whole loan thing worked. It was so easy that now we laugh at the idea of trying to understand the process. There is no process. It’s our money!”