Executive Summary: Given the poor track record of the government and private sector when it comes to safeguarding the financial security of Americans, the authors propose a Declaration of Financial Independence in which individual citizens pledge to take responsibility for their own lifelong financial well being.

Americans need a financial revolution in 2011 as surely as we needed a political revolution in 1776.

Our system of earning, saving and investing money simply is broken. It relies way too heavily on the tag team of government and mega-banks and financial institutions, and way too little on the self-reliance and individualism that made our nation great.

The federal government, by every reasonable standard, has proven to be a poor steward of our money and financial security.

The lockbox that was supposed to be Social Security – with Uncle Sam holding our funds – repeat, “our” funds – for us, turns out to be a thinly veiled Ponzi scheme that is rapidly draining to insolvency. Ditto Medicaid.

It was the circus-like policies of the government-backed Fannie Mae and Freddie Mac that led directly to the housing crash in 2008 and turned the American Dream – owning one’s own home – into a financial nightmare for tens of millions of us.

The federal government poured close to $600 billion taxpayer dollars into the bailout of unstable private businesses, including AIG, Bank of America, Citigroup, Goldman Sachs, Morgan Stanley, General Motors, etc. – rather than permit the free market to right its own wrongs.

Our national debt has spiraled out of control and threatens the very solvency of our nation. Whether or not we actually default on our obligations, two consequences seem inevitable: inflation will return (sapping our spending power) and taxes will rise – that is, if in our crazy tax system, you are not among the nearly half of all Americans who pay no taxes whatsoever.

If times get tough enough, the United States might even see the kinds of austerity-inspired street riots that have shaken Greece, where those who have become accustomed to suckling on the government teat get very angry when the spigot runs dry.

And what of the perplexing U.S. tax code and its ever-growing lock on our income? We simply don’t have enough rich people in our country to zap with higher taxes in order to offset the government’s spending addiction.

As Margaret Thatcher once said, although at the time it was socialism generally, not just taxes on her mind:

The trouble…is that you eventually run out of other people’s money”

Hence, regardless of your current tax bracket, soon enough you can count on the taxman knocking on your door asking for even more.

If the argument for a break from our reliance upon the federal government’s management of our money isn’t compelling enough, our additional reliance on private banks, securities firms, money managers and the mainstream financial news media to protect and help grow our wealth is even worse.

Wall Street and other peddlers of financial snake oil have spent fortunes in the effort to convince ordinary, hard-working Americans to place our trust and our financial futures in their hands.

Will we never learn?

Market crash after market crash, investment bubble followed by investment burst, our money enjoys no rest from the seesaw, stomach-wrenching ups and downs that result from following the advice of these so-called experts.

Want to join the hundreds of thousands of Americans who have put their foot down and said “NO!” to volatility and unpredictability in their financial plan? Request a FREE Analysis Now and find out how much your financial picture could improve with the Bank On Yourself system that has only one direction: UP!

Not only do tens of millions of us frequently get jarred from our trance-like state to discover we’ve lost a huge chunk of our nest eggs just when we need our money most, but if we look carefully we also realize that our advisors and money managers have walked off with a sizeable portion of our assets, masked behind the fine print of fees and expenses.

The crumbs our advisors leave for us – if they leave any at all – are then subject to additional taxes from our good friends in the U.S. Government.

The crumbs our advisors leave for us – if they leave any at all – are then subject to additional taxes from our good friends in the U.S. Government.

Taken together, the abuses of government and private financial institutions may not rise to the level of misdeeds that our forefathers suffered at the hands of their British overlords, but they do suggest the need for all right-thinking Americans to free themselves – as much as humanly possible – from the tyrannies of today’s financial despots.

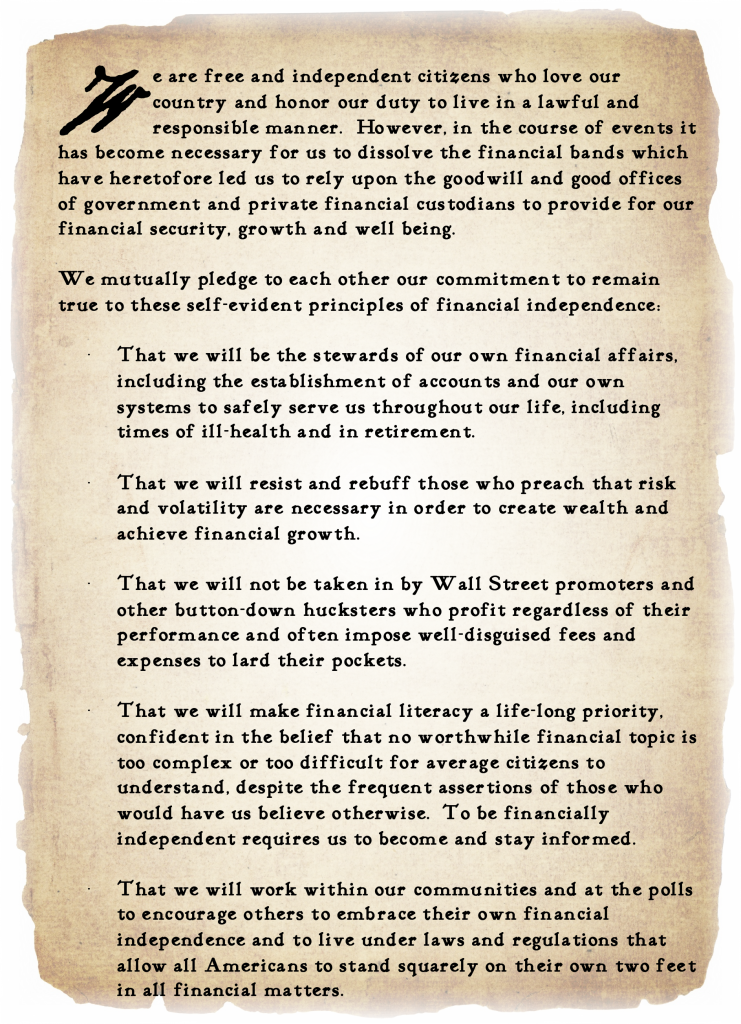

So, in the spirit of Thomas Paine, Thomas Jefferson, John Adams, John Hancock, Benjamin Franklin and other revolutionary thinkers, we propose this Declaration of Financial Independence…

Writing about Thomas Paine, whose release of Common Sense in January 1776 helped spark the American Revolution, one pundit noted that Paine “was an unremarkable man living in a remarkable time.”

Once again, America finds itself in a remarkable time at a remarkable juncture of our history.

Declaring our Financial Independence is an act of patriotism and very much in keeping with the spirit and intent of our forefathers, who gave their lives, fortunes and sacred honor to secure our liberties – including the freedom to direct our own finances and embrace the principles of self-reliance.

The torch has been passed. It’s our turn now to act with confidence and courage in these momentous times.

Pamalla,

Thanks for inspiring and hiring the many people who help us to become financially “free”

Happy forth of July to you and yours,

God Bless,

David

With the recent flucuations in the market, I’m so thankful and relieved that we’ve moved to the Bank on Yourself program. This really is the way to declare our financial independence.

I may be too old ( 82 ) to use your service.

I would not be comfortable putting all my savings in a company that may go broke.

There are programs available for people up to age 85.

Where are you putting your money now? Whether its stocks, real estate, gold or other traditional investments, you can lose most or all of it.

If it’s in a bank beyond the FDIC insurance amount, you can lose it, too.

Wanna have some fun? Google “how many people have lost money in banks” and then Google, “how many people have lost money in whole life insurance?”

I know of no safer or better place to put your money then in a properly structured dividend paying whole life insurance policy from a top-rated company.

These companies enjoy a 5-layer safety net.

It’s nice to have a plan available after all the confusing information out there.

What happens if the dollar totally collapses? I hear talk of silver and gold.

Here’s my take on what would happen in a doomsday scenario.