Let me cut through the hype and give you the scoop: The 501(k) plan is just the latest name the Palm Beach Research Group has given to the concept most people know as Bank On Yourself, which is based on a high cash value dividend-paying whole life insurance policy.

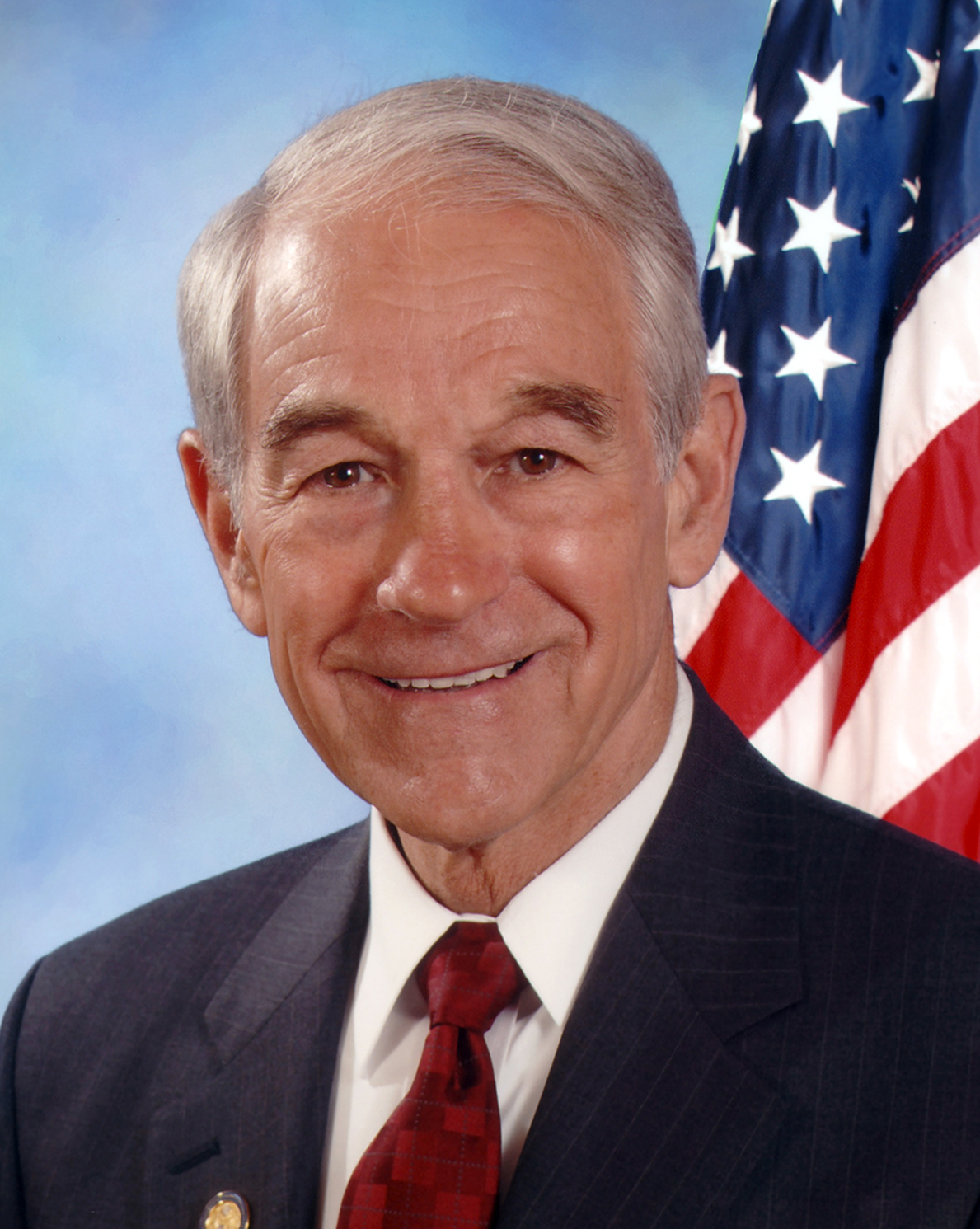

The Palm Beach Group has been bombarding subscribers to various email lists about a “warning” issued by the “Father of the 401(k),” Ted Benna.

The Palm Beach Research Group wants you to watch a long video interview they did with Ted Benna, where he reveals three dangers he sees coming that could impact your 401(k) and IRA accounts. He says these dangers could slash your savings by 40%. And you’re promised that by watching this long interview you’ll learn about “a non-government sponsored 501(k) plan” that may “be the only way left for most Americans to retire today.”

This secret plan is touted as a 401(k) alternative “account,” where Benna and some prominent members of Congress have put some of their savings, to shield them from these three dangers.

Unfortunately, even after you watch the lengthy interview with Ted Benna, you still won’t know what this “account” actually is—until you fork over $75 to $149 to subscribe to the Palm Beach Letter and get your copy of their “new” book, The 501(k) Plan: How to Fully Fund Your Own Worry-Free Retirement—Starting at Any Age.

And the Palm Beach Group further confuses people by calling it a “501(k)” when there already is a provision of IRS code–Section 501(k)–that relates to tax treatment of child care organizations, and has nothing to do with the 501(k) the Palm Beach Group is talking about! (It should also not be confused with Section 501(b) which relates to financial institutions and privacy.)

You can’t judge this book by its cover

“New” book? As it turns out, this is not a new book at all! They simply slapped a new title on a book they published a couple years ago about alternative retirement investments, and added a foreword by Ted Benna. The old book was called The Big Black Book of Income Secrets. In fact, at least once in the “new” book, they forgot to change the name and they call their “501(k) Plan” book The Big Black Book of Income Secrets.

You can read my review of this “new” book under its original title, The Big Black Book of Income Secrets, here. My review points out all the red flags regarding the strategies covered in the book that should cause you concern. In addition, many of these strategies are not new at all, and some are exceedingly complex.

The Palm Beach Group Used to Call the “501(k) Plan” “President Reagan’s Secret 702(j) Retirement Account,” and Before That, the “770 Account”

These are all names they gave to what most people know as the Bank On Yourself concept I’ve been talking about since 2001. They’re using sleight of hand, hoping to keep you from getting the full scoop for free. You can learn all you need to know about the 501(k) when you download my 20-page Report on this strategy—5 Simple Steps to Bypass Wall Street, Beat the Banks at Their Own Game and Take Control of Your Financial Future—right here for FREE.

Download your free report

In this report, you’ll get the full story about the “501(k) Plan”—minus the misinformation and hype—that Palm Beach Group wants you to pay good money for. You can also see what they got right—and wrong—about this concept in my blog posts about the 770 account and President Reagan’s Secret 702(j) Retirement account.

Why Does the Palm Beach Research Group Keep Changing the Names of Its Products and Strategies?

Because if you knew the earlier names they gave to their books and strategies, you could just Google them and get the scoop—for free. Google would direct you to Bank On Yourself and then the Palm Beach Research Group couldn’t trick you into paying as much as $3,000 or more for each for their newsletter and advisory services.

Spoiler Alert: The 501(k) plan Palm Beach Group talks about is a time-tested, safe wealth-building strategy based on high cash value, low commission, dividend-paying whole life insurance that’s been used by wealthy, successful people, presidents and famous entrepreneurs for well over a century. But almost anyone can use it to take control of their money and finances – regardless of age or income – as you’ll discover when you download this FREE Special Report.

Something Happened That the “Father of the 401(k)” Never Foresaw

Ted Benna is widely credited with finding a way to capitalize on provisions of the Internal Revenue Code Section 401(k) to create a way for working men and women to augment their retirement savings, beyond the pensions many workers received.

But Big Business and Wall Street perverted the 401(k) concept in ways that Benna couldn’t possibly foresee, and in 2011 Ted Benna said he had created “a monster” that should be “blown up.”

Our hats are off to this man with integrity and the courage of his convictions.

3 Big Takeaways from Ted Benna’s Presentation on the 501(k) Plan

There are three key points that Ted Benna made in his recent interview for Palm Beach Group:

1. The first was the danger that government-sponsored retirement plans could be “repealed”

Benna says, “There could be a repeal of the tax advantages these plans offer. So either you won’t be able to put any more money pre-tax into accounts like 401(k)s and traditional IRAs, or the amount you can put in each year will be drastically reduced.”

2. Benna says he believes the next stock and bond market crash is imminent and could wipe out up to 40% of the typical portfolio

He says, “If you’re retired—or on the verge of retirement—and you’re trying to plan a few years down the road, this is something you’ve got to pay serious attention to. Because, if you’re planning your retirement expecting your portfolio will grow at, say, 5% or 6% a year, what happens if another ’08 comes our way next month? What happens to your retirement accounts? … I lost more than I like to admit in my own 401(k) 10 years ago. So I try to learn from my mistakes.”

3. 401(k)s and IRAs have been “hijacked” by Wall Street

“The third danger is fees. This is more of a ‘hidden’ danger. And it’s already here. It’s hidden because it’s not as drastic as, say, a 40% drop in stocks or bonds. But, over the long run, it’s just as deadly. … The average household is paying $155,000 in fees over the course of their lifetime. That’s a significant amount of cash. And all this money is going to Wall Street.”

Benna makes the point that excessive fees charged by mutual fund companies and plan administrators are robbing you of up to half of your nest egg.

I’ve been warning of these dangers and others for years. For starters, see …

Want more information about America’s most popular (and scariest?) retirement plan? Just click here to see all of the search results for “401(k)” on our site.

Benna Says the 501(k) Plan, Better Known as Bank On Yourself, Avoids the Dangers That Traditional Retirement Plan Accounts Face

He’s right. In fact, I’ve been saying that for years.

Benna says that for these reasons and more (including the tax advantages), he has, in his words, “put most of my money in the 501(k).”

Ted’s got it right. The 401(k) is a troubled concept. In fact, the idea of individual wage earners investing their life savings in the stock market is a troubled concept.

And, as Ted eloquently explained, a plan such as Bank On Yourself (which Ted Benna and the Palm Beach Research Group have chosen to dub the 501(k) Plan) neatly sidesteps all those problems, and provides some additional advantages, as well.

So What Exactly Is a “501(k) Plan”?

“501(k) Plan” is just the latest mysterious-sounding name the Palm Beach boys have given to their strategy that copies Bank On Yourself. And Bank On Yourself, as we are always happy to explain, is a safe savings and wealth-building strategy based on a specific type of high cash value dividend-paying whole life insurance.

No, it’s not the kind of permanent life insurance that most self-proclaimed financial gurus love to hate. There are major differences. But it is a form of supercharged permanent life insurance.

![[this account] has become a tax shelter for the rich... it gives the affluent tax advantages far beyond those available to middle-income people through a 401(k) or IRA.](/wp-content/uploads/Wall-Street-Journal-life-insurance-pull-quote-from-2010.jpg) Want proof that’s what the Palm Beach Group is talking about? In the transcript of their long interview with Ted Benna, Palm Beach includes a quote, attributed to the Wall Street Journal. Note that they’ve removed the Journal’s identification of the product and replaced it with their own vague words, “this account.”

Want proof that’s what the Palm Beach Group is talking about? In the transcript of their long interview with Ted Benna, Palm Beach includes a quote, attributed to the Wall Street Journal. Note that they’ve removed the Journal’s identification of the product and replaced it with their own vague words, “this account.”

A look at the Wall Street Journal report they’ve quoted shows what the Journal actually said back in 2010: “Permanent life insurance has ‘become a tax shelter for the rich.’”

We include that Wall Street Journal quote only to demonstrate what the Palm Beach Research Group is talking about. You will realize that permanent life insurance is not a tax shelter merely “for the rich” when you read our article, “The Truth About Whole Life Insurance and Why It’s More Than a ‘Rich Man’s Roth’.”

In the interview Ted Benna did for the Palm Beach Research Group, he discussed what you’ll find in The 501(k) Plan book they are promoting. He said you’ll learn the details of this “account” and how to open one, in the first chapter of the book.

And Chapter 1 of the book is all about “Income for Life,” which is yet another name the Palm Beach Group gave to the concept and strategy more commonly known as Bank On Yourself.

It’s crystal clear. The Palm Beach Group would like to sell you information we believe you’re entitled to have for free. And we’ve been giving that information away for free in this Special Report and on our website since 2001.

How to Open Your Own “501(k) Plan” or Account

… or what you now realize is better known as a Bank On Yourself plan.

You need to talk with a life insurance advisor who has been trained in the special requirements of high cash value life insurance policy design. But on page 46 of their book, The 501(k) Plan, the Palm Beach Group makes this outrageously untrue claim:

The government regulates the fees life insurance agents can charge you. So from a cost perspective, it doesn’t matter whom you choose. You’ll pay the same.”

Let me set the record straight: It absolutely matters who you choose to help you open your 501(k) plan …

The government does not regulate the fees, and even if the amount you pay were the same from company to company, which it is not, the advisor has great discretion in how he structures your plan. Done one way, he gets paid about what life insurances advisors traditionally get paid.

But done with your best interests in mind, the advisor’s compensation is slashed by 50% ‑ 70%, and that “extra” money goes into building your policy’s cash value. Bank On Yourself Professionals are committed to this concept and are willing to accept a compensation cut, knowing you’ll be so pleased with the performance of your plan that you’ll refer your advisor to your family and friends, as well. In fact, that happens all the time.

Talk to Someone with Your Interests in Mind to Start Your 501(k) or Bank On Yourself Plan

To talk with an advisor with extensive training in this area who cares about your welfare, you want to talk with a Bank On Yourself Professional. It may surprise you to know that only about one out of every 20 insurance advisors who apply to become Bank On Yourself Professionals are actually accepted. The training and commitment required are that tough.

So go to the source that’s been open and straightforward with you from Day One, Bank On Yourself. Request a FREE Analysis and custom-tailored recommendations at no cost or obligation. You’ll get a referral to an Bank On Yourself Professional (a life insurance advisor with advanced training on this concept) who will prepare your Analysis and personalized recommendations.

![[this account] has become a tax shelter for the rich... it gives the affluent tax advantages far beyond those available to middle-income people through a 401(k) or IRA.](/wp-content/uploads/Wall-Street-Journal-life-insurance-pull-quote-from-2010.jpg) Want proof that’s what the Palm Beach Group is talking about? In the transcript of their long interview with Ted Benna, Palm Beach includes a quote, attributed to the Wall Street Journal. Note that they’ve removed the Journal’s identification of the product and replaced it with their own vague words, “this account.”

Want proof that’s what the Palm Beach Group is talking about? In the transcript of their long interview with Ted Benna, Palm Beach includes a quote, attributed to the Wall Street Journal. Note that they’ve removed the Journal’s identification of the product and replaced it with their own vague words, “this account.”