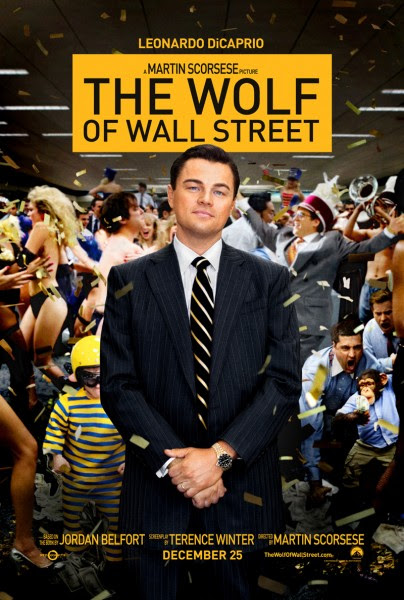

If you haven’t seen the Oscar-nominated movie, The Wolf of Wall Street yet, I’m not necessarily suggesting you see it.

It’s based on a true story of Wall Street’s excesses, and it’s chock-full of graphic scenes of sex, drugs and debauchery. And it’s l-o-o-o-o-o-n-g – about three hours.

But whether you decide to see it or not, there’s a scene in it that is so profound, I’m going to spill the beans about it here. It’s the best ten seconds of any movie I’ve seen in quite a while, especially given the 1,200-point drop in the Dow over the last couple weeks. But first, here’s a little background info…

But whether you decide to see it or not, there’s a scene in it that is so profound, I’m going to spill the beans about it here. It’s the best ten seconds of any movie I’ve seen in quite a while, especially given the 1,200-point drop in the Dow over the last couple weeks. But first, here’s a little background info…

The movie, directed by Martin Scorsese and starring Leonardo DiCaprio, is based on the autobiographical book by Jordan Belfort, which details his rise and fall on Wall Street.

Belfort had just finished training at a major Wall Street firm, and on his first day as a licensed stock broker, the world markets crashed. It was “Black Monday” – in October, 1987.

The firm was one of many that soon closed down, and Belfort was out of a job. But not for long. He soon discovered a world of white-collar crime, taking over a Long Island penny-stock cold-calling boiler room, and was soon making millions by convincing investors to buy stocks his company had invested in, and then selling the stocks for a huge profit. The investors were left with worthless holdings.

Ultimately, after a Federal investigation, Belfort pleaded guilty to securities fraud and charges of money laundering. Rather than face decades behind bars, he became a government witness. He ended up serving 22 months in prison and was ordered to pay his fraud victims $110 million in restitution. He was also barred from the securities industry for life.

Believe it or not, today Belfort gets paid big bucks by major corporations to teach their sales reps “the art of Straight Line Persuasion – how to create instant rapport, control the sales conversation and close every single deal that’s closeable.”

Really! You can’t make up stuff this good!

And he hasn’t paid most of the $110 million he owes to his victims, but that’s another story.

Nothing has really changed on Wall Street, as I reveal in the article I wrote this summer, “A Month of Scams and Scandals on Wall Street.” And JP Morgan Chase just gave a 74% raise to Chief Jamie Dimon in a year in which the bank paid more than $20 BILLION in fines and other legal costs.

Now for the Best 10 Seconds in the Movie

Anyway, on Belfort’s first day as a broker at the big, prestigious Wall Street firm, the head of the company (played masterfully by Matthew McConaughey) takes him to lunch at the 5-star restaurant on the top floor of the building, to rid him of his naïve beliefs. Like thinking that being a stockbroker is a win-win, because if the client makes money, the broker makes money.

Belfort quickly learns that nobody knows what direction any stock will go.

And then Belfort gets let in on the big secret:

Our clients make money (pauses for dramatic effect) -ON PAPER- while we take our commissions out in cold, hard cash”

And that’s the critical difference Wall Street hopes you never figure out. They always get paid, whether we win or lose.

I devote an entire chapter to this in my new book, The Bank On Yourself Revolution, which hits the stands on Tuesday. (You can save 27% when you buy it today on our website.)

Those glowing reports about how much Americans’ wealth had ballooned prior to the financial crash were pure fiction. Unless and until you sell your assets and lock in your (hopefully) gains, you have nothing more than a bunch of eye-popping numbers ON PAPER. Those numbers repeatedly sucker many of us into believing we have real wealth and financial security when we do not.

The same thing is true about our home values – the meteoric rise in values we saw is only an unrealized or PAPER gain.

And you can’t eat a number on paper…

I think the timing of the movie – and of the message in this email – is very timely. The incredible rally in the markets over the last few years was another example of wealth ballooning – ON PAPER. No one knows how deep or long this current correction might be. Or if this is the start of another full-blown crash (the third one in 14 years).

I don’t know and neither does anyone else. And that’s the problem. Too many of us have pinned our hopes for financial security on things we can’t predict or count on – and never will be able to.

So if you have questions about Bank On Yourself, policy loans, or you’d like to see how adding to your Bank On Yourself portfolio can help you reach more of your goals and dreams – without taking unnecessary risks – Request an Analysis today.

The Bank On Yourself method is different. The numbers on your annual statement represent real wealth that doesn’t disappear when the markets crash.

Bank On Yourself has many important advantages not offered by traditional investments, including:

- Your money grows predictably and guaranteed

- It doesn’t go backward or suffer a lost decade (or even a single lost year)

- You can know – right from the start – the guaranteed amount it will grow every year

- You can access your money in the plan when you want and for whatever you want, and your plan keeps on earning interest and dividends as though you never touched a dime of it

So why not find out what your bottom-line numbers and results could be if you added Bank On Yourself to your financial plan? It’s easy to do when you request a free Analysis, if you haven’t already.

Speak Your Mind