Executive Summary: The life-long costs of neglecting your health can be staggering. Expenses include out-of-pocket medical bills as well as losses of productivity and quality of life. Too many people watch their investments more closely than they do their health. Illness brought on by lifestyle choices, such as smoking, overeating, lack of exercise and stress, accounts for as much as 70% of nationwide health care spending.

By Pamela Yellen and Dean Rotbart

In mid-December 2008, a skeletal Steve Jobs, CEO of Apple Inc., canceled his scheduled presentation at the annual Macworld conference, triggering investor fears that the company’s visionary co-founder was seriously ill. A month later, Jobs announced his first health-related leave of absence. He began a second leave this past January.

During the 30-day period when concerns about Jobs originally surfaced, the shares of Apple stock dropped 14%, or $12 billion in market value.

The shareholders of Apple weren’t worried about the potential hospital bills and other medical costs that Jobs would incur. Comparatively speaking, those expenses would be a drop in the bucket.

But Apple shareholders – confronted with the loss of Jobs’s services, perhaps for good – instantly realized the true cost of sickness must also be measured in loss of productivity, leadership and innovation, among other attributes a key executive brings to his or her company.

For tens of millions of Americans who are otherwise mindful of how and where they stake their money and retirement savings – including many successful Bank on Yourself participants – the importance of investing wisely in their physical health is a lesson they have yet to master.

That’s a huge fiscal mistake

Whether you are the CEO of a Fortune 500 company or the chief executive of your family, the extent to which you do everything reasonable to protect yourself against illness and disability is unquestionably one of the most important financial – yes financial – investments you can make during your lifetime.

Are you paying the couch potato tax?

If you smoke, overeat, sit too long each day at a desk, permit stress to dominate your thoughts, consume too much alcohol, or avoid regular doctor visits and medical tests, you can’t really say you are a wise investor – regardless of what your balance sheet tells you.

Additional reading: 7 Ways You Can Build Your Wealth Through Better Health

There are surprisingly few academic studies, news articles or books that focus on health and prevention primarily from a personal finance point of view. Yet the available statistics demonstrate overwhelmingly that we should all be spending at least as much time educating ourselves and investing in healthy lifestyles and diets as we do studying returns on investment and tax shelters.

Often, the price we pay for inattention to the care and feeding of our bodies doesn’t become evident for years or even decades. However, when the tab does finally come due, it is often shockingly high and can instantly erase a life’s worth of careful financial planning.

The specific costs of illness are hard to generalize, varying widely depending upon the patient’s age, duration and severity of illness, and other factors, as well as the quality of an individual’s health insurance coverage.

Most studies and statistics thus focus on the average price we pay in terms of medical bills and pharmaceuticals.

Take diabetes, which already afflicts one in ten Americans and according to the Centers for Disease Control and Prevention could strike one in three of us by the year 2050.1

Diabetes patients already can expect to spend $6,000 a year for treatment of their illness, including monitoring supplies, medicines, doctor visits, annual eye exams and other routine costs.1 And that figure doesn’t count the costs of treating some of the common complications caused by the disease, including heart disease, strokes, and damage to the eyes, liver and kidneys.

A 40-year-old patient who is diagnosed with Type 2 diabetes in 2011, assuming an average annual inflation rate of 3.1%, will spend more than $240,000 out-of-pocket by the time he or she turns 65 years old in 2036.2 That is nearly a quarter-million dollars less at retirement than if the same funds had simply sat in an interest-free safe deposit box the entire time.

What makes Type 2 diabetes such a losing ‘investment’ is that 80% of the cases in the United States can be prevented by those who quit smoking, eat a healthy diet and routinely exercise, according to Dr. Ronald Loeppke, vice chairman of U.S. Preventive Medicine, a company that provides wellness and prevention programs to businesses and individuals.1

More serious illnesses come with more serious price tags

A heart attack, for example, will cost a typical patient $110,405, according to a 2009 Consumer Reports Health study.3 Even those who are well insured are often required to supplement their coverage with substantial out-of-pocket payments. Treatment for breast cancer averages $104,535, while trying to beat late-stage colon cancer costs nearly $300,000.3

But these figures do not take into account the less obvious – but potentially much costlier – impact that illness has on income and productivity.

When you are sick, you are not as effective on the job, in your investing strategies or at home. Those who depend upon you are also less efficient when you’re not well. Often, colleagues have to pick up your slack at work – rendering them less effective in their own assignments, while family members have to skip work or sacrifice their own productivity in order to care for you.

If your life expectancy is reduced due to your illness, so, too, might your productive work and income-generating years. When illness leads to early or permanent disability, the costs may require special nursing home or long-term care expenses.

Other tolls, such as the worry, insecurity and loss of companionship that illness forces on the loved ones of a patient, can’t be measured in dollars. Nor, of course, can anyone put a price on what sickness means to you in terms of pain, incapacity and forfeiture of quality of life.

The American Journal of Medicine reported in 20074 that more than 62% of all bankruptcies in the United States stemmed directly from medical debts or the loss of income due to illness. “Most medical debtors were well educated, owned homes, and had middle-class occupations. Three quarters had health insurance,” the report found.

Beyond the impact on our individual lives, the collective cost to American society in terms of care and lost productivity is staggering.

Are You Prepared for a Medical Emergency?

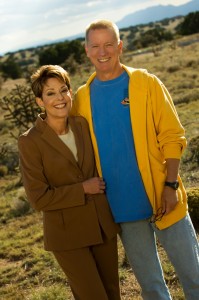

When Pamela Yellen’s husband Larry had to have emergency quadruple heart by-pass surgery, they got stuck with $15,000 of medical bills their health insurance didn’t cover.

But thanks to Bank On Yourself, they were able to borrow enough from their policies to pay off the bills in full, instead of having the stress of piling on credit card debt. Just two years later, they had paid back the loan and, as a result, recaptured those medical expenses into their policies, along with the interest they would have paid to a credit card company, plus a “profit.”

That’s when it really hit home for Pamela what a lifesaver Bank On Yourself can be. The Bank On Yourself concept can provide a cash cushion and peace of mind to help you weather unexpected medical expenses, disability, job loss, or other emergencies. You don’t have to fill out any prying credit applications. You can skip some payments on your loans and no one is going to make intimidating phone calls, repossess your things, or foreclose on you. No late fees and no black marks on your credit report.

To me, Bank On Yourself is the ultimate financial security blanket. You can reduce and ultimately eliminate the control banks and financial institutions have over you.”

~Pamela Yellen, President

Bank On Yourself

The United States already spends more on health care for each of our citizens than any other nation in the world

That includes $1.5 trillion in medical costs related to chronic diseases with a direct link to smoking and obesity, including cancer, heart disease and diabetes.5

Dr. Regina Benjamin, the U.S. Surgeon General, estimated that in 2010 more than 616,000 Americans would die of heart disease, costing our country $316 billion. Dr. Benjamin forecast another 560,000 Americans would die last year from cancer, at a cost of $264 billion.6

If current trends continue, Dr. Benjamin writes that within seven years, the United States could spend as much as $344 billion annually on health costs attributable to obesity alone – an amount accounting for 21% of the nation’s total direct health spending.6

At least one major study, conducted in the 1990s, found that 40% and possibly as high as 47% of deaths in the United States were caused by behavior patterns (diet, lack of exercise, tobacco, alcohol, etc.) – meaning they could have been prevented.7

“At least 70 percent of health care spending is related to lifestyle,” The Milken Institute Review reported last year. “While genes cause or contribute to some disease, our excess weight, tobacco use and poor exercise habits are far more damaging,” the publication noted.8

Of course, even those who take excellent care of themselves, exercise regularly and control their diets can become ill. Genetics, environmental factors and accidents are among the most common causes of non-preventable illnesses.

In such instances, having ready access to emergency funds, such as those designed into most Bank on Yourself programs, can literally be a lifesaver. Bank on Yourself’s specialty trained and Professionals regularly construct plans for their clients that help policyholders set aside 10% of their gross income for contingencies, specifically including health emergencies.9

For those seeking to shore up their health, there are countless books and magazine articles that can provide guidance

Most of the advice can be followed at little or no cost, and some steps, such as quitting smoking, can actually put money in your pocket. (Think of how much you’ll save alone on a pack-a-day habit or cutting out high-fat, high-calorie daily coffee drinks.)

Most of the advice can be followed at little or no cost, and some steps, such as quitting smoking, can actually put money in your pocket. (Think of how much you’ll save alone on a pack-a-day habit or cutting out high-fat, high-calorie daily coffee drinks.)

In 1736, when Benjamin Franklin organized Philadelphia’s Union Fire Company, his goal was to reduce the economic loss and suffering that arose when citizens lost their homes to fire. Nonetheless, his words served then and serve still as a reminder of the investment returns that can be realized by those who tend to their health long before they are ever required to do so.

As Franklin understood…

An ounce of prevention is worth a pound of cure.”

The advice is no less true today.

I am stressed all the time and 20lbs overweight. If I didn’t have a full time job, I feel I would have MUCH less stress and I could focus on exercising more. I would also eat out less and eat from home more and since I eat organic local seasonal and sometimes raw or paleo, I would benefit. Full time employment sucks out my life force and joy!

I hear you. However, I work way more than full-time and still find time to work out and eat right. Doing those things actually gives you more energy! You just have to make the decision to “just do it.”