[wfacp_forms]

Category: Uncategorized

Infographic: The Crisis in Pensions and Retirement Plans

A brief history of retirement in the U.S.

Source: Accounting-Degree.org

What’s the difference between dumb money and smart money?

Have you ever heard the old Wall Street adage, “In investing, the majority is always wrong”?

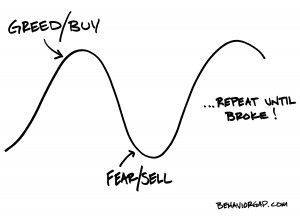

Have you ever told yourself you’re done with the stock market forever?! But then the market starts to rise. The Wall Street jocks tell you non-stop what you’re missing out on. Your friends talk about how much their investments are going up – and you jump back in because you can’t stand the pain of watching it rise day after day without you!

I heard a well-respected investment analyst interviewed about why he believed the stock market rally still had legs in spite of the fact that it had recently nearly doubled.

He said, “People who missed out on the rally will jump in and propel the market higher.” Really? Have you heard that old saying…

If you’re sitting at a poker table and you can’t figure out who the sucker is, it’s you?”

The investing world has a specific technical term for that kind of investing: dumb money. When the dumb money is piling into the market, you know it’s about to reach a top. And when the dumb money is fleeing the market, a bottom isn’t very far away. Dumb money, which is a heck of a lot of investors, misses the mark on both sides.

Students of history will tell you how rare it is for a market to continue rising after such an extraordinary rally – only a handful of bull markets in S&P 500 history have gained more than 100%. And right now, with the market up about 150% from the bottom, the air is even more rarefied.

The problem is that none of us knows when the market will top out… or how deep the crash that inevitably follows will be. History reveals that the faster and higher the market goes up, the steeper the fall.

The real estate market is getting pretty frothy, too. The Case-Shiller home price index was up 12.2% in May over a year ago – the biggest year-over-year jump since near the peak of the housing bubble in 2006.

Paper wealth versus real wealth

During the last bubble that peaked in 2007, few people anticipated that both their retirement accounts and their home equity would be decimated at the same time.

That’s when it became painfully clear that the balances of our investment and retirement account statements and the appraisals of our homes were nothing more than a bunch of eye-popping numbers on paper. Those numbers repeatedly sucker many of us into believing we have real wealth and financial security when we do not.

Last week, Wall Street journalist Brett Arends noted…

Mom and Pop investors have returned to the market and have been buy stocks since the beginning of the year. History says their timing is absolutely terrible.”

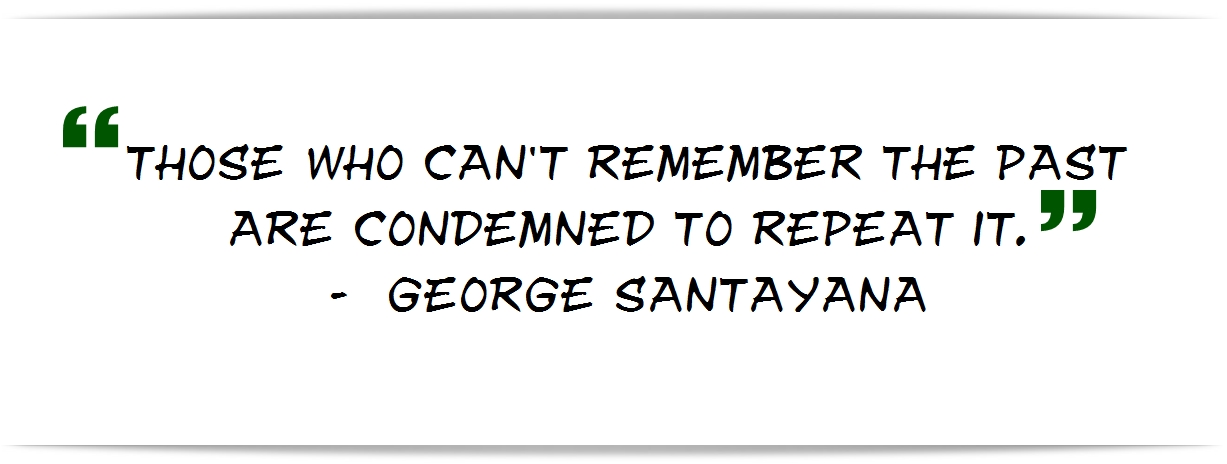

The last bubble burst just six years ago, and already many people have forgotten the pain of the Great Recession. According to the behavioral finance experts, part of the reason for this is that we humans have an amazing capacity to forget our losses and exaggerate our successes.

But the more important question is – what lasting lessons did you learn from the financial crisis?

Take this quick survey and share your biggest takeaway with us!

If you find yourself tempted to follow the “dumb money” into stocks, real estate and other volatile investments (and there’s no question that watching markets rise without you day after day can be very painful), I encourage you to keep in mind these words of George Santayana:

Take some time and reflect back on the lessons you’ve learned since 2000 before acting.

Then find out how much financial security and peace of mind you could have when you take the volatility and randomness of the market out of your financial plan. When you Bank On Yourself, your plan never goes backwards and both your principal and gains are locked in. That’s where the smart money is.

The typical investor lost 49% or more of their nest-eggs – TWICE – just since 2000. It could happen again in five or ten years… or even tomorrow. Is that a risk you really want to take again?

Request Your FREE Analysis and Find Out Your Bottom-Line Numbers!

No two Bank On Yourself policies or plans are alike – yours would be custom tailored to help you reach as many of your short-term and long-term goals as possible. There’s no obligation and no one is going to twist your arm. So take the first step and request your FREE Analysis now, while it’s fresh on your mind!

Corporate accountant discovers Bank On Yourself… and now smiles when the market crashes

Derek Logan is the textbook “poster boy” for someone who did all the right things we were taught to do financially. He’s been working since he had a newspaper route at age 10. He diligently set his goals and used a budget system. He maxed out his 401(k) and had his home paid off by the age of 45 – even though he and his wife moved 13 times in their first 21 years of marriage. And he paid cash for major purchases.

But he still got blindsided several times by the totally unpredictable ups and downs of the stock market.

As a corporate accountant for more than 30 years, Derek realized he had set – and achieved – all of the goals he set for himself… except for the goal of being able to retire at a specific age with a specific amount of money.

Disheartened and frustrated because he was closing in on his hoped-for retirement age, but his retirement account had been decimated several times, he began to do a lot of soul searching. He was willing to be open to other alternatives.

Fortunately, my best-selling book landed on his kitchen table as a Father’s Day gift… and the rest, as they say, is history.

Beware the "Behavior Gap": Interview with Carl Richards

I’m delighted to share this fascinating interview with Carl Richards with you. Carl writes a weekly essay for The New York Times “Your Money” section and has been a Certified Financial Planner for 15 years. His witty sketches have appeared in numerous publications, including the Wall Street Journal, Morningstar and The New York Times.

Over the years, he noticed that the actual real-life returns the average investor gets are dramatically lower than the return of the average mutual fund. He named this phenomenon the Behavior GapTM and began devoting his energy to explaining why the Behavior Gap exists and what constitutes smart investor behavior.

Carl recently shared his surprising insights, tips and strategies with me in an audio interview. I hope you’ll listen to it today – I know you will find it very helpful!

You can listen to the interview by pressing the play button below, or you can download the entire interview as an Mp3 and listen on your own player or iPod…

You can also download a transcript of the interview here.

Here’s what you’ll discover in this interview…

- Why 80% of all actively managed mutual funds and investment advisors underperform the overall market

- The #1 biggest mistake individual investors make over and over again… and why most will keep making it

- The keys to being a smart investor

- How to determine if you should be investing in equities at all

- The real key to happiness (it isn’t what you might think!)

- How to practice “radical self-awareness” so you control your money rather than letting it controlling you

- Why happiness is directly related to how much you focus on the things you can control

- How to increase your wealth and happiness by focusing your energy on three things you do have control over!

You can listen to the interview by pressing the play button below, or you can download the entire interview as an MP3 and listen on your own player or iPod…

You can also download a transcript of the interview here.

Improve Your Financial Picture…

To find out how much your financial picture could improve if you added Bank On Yourself to your financial plan, request a free Analysis. If you’re wondering where you’ll find the funds to start your plan, the Bank On Yourself Professionals are masters at helping people restructure their finances and free up seed money to fund a plan that will help you reach as many of your goals as possible in the shortest time possible.

Six Frequently Asked Questions about Bank On Yourself

I thought you might find it helpful to have the answers to the six questions about Bank On Yourself we’re most often asked – right at your fingertips.

How many of these questions have you been wondering about?

![]() FAQ #1: How does Bank On Yourself compare with traditional investing and savings strategies?

FAQ #1: How does Bank On Yourself compare with traditional investing and savings strategies?

You can compare the Bank On Yourself method to traditional investments here, including stocks and mutual funds, a 401(k), a ROTH plan, real estate, gold, commodities and several other investments.

If there’s a different financial product or strategy that you think can match or beat the Bank On Yourself method, I encourage you to take the $100,000 Challenge. If you’re right, you could pick up an easy $100K!

![]() FAQ #2: How does Bank On Yourself let you recapture every penny you pay for major purchases like cars, vacations, business equipment or a college education?

FAQ #2: How does Bank On Yourself let you recapture every penny you pay for major purchases like cars, vacations, business equipment or a college education?

I’ve summarized this in a short video overview of how Bank On Yourself works.

However, for a more detailed explanation, you’ll want to review Chapters 2, 6, and pages 52-54 of my best-selling book, Bank On Yourself. If you don’t have the book, we offer a 35% discount on it.

![]() FAQ #3: I’ve heard people like Dave Ramsey and Suze Orman say whole life insurance is a lousy place to put your money. Is a Bank On Yourself-type policy different from the kind they’re talking about?

FAQ #3: I’ve heard people like Dave Ramsey and Suze Orman say whole life insurance is a lousy place to put your money. Is a Bank On Yourself-type policy different from the kind they’re talking about?

[Read more…] “Six Frequently Asked Questions about Bank On Yourself”

Government Motors?

Remember the old jokes about what it would be like if Microsoft built cars?

For no reason whatsoever, your car would crash twice a day… the airbag would say “are you sure?” before going off… executing a maneuver would occasionally cause your car to stop and fail to restart and you’d have to re-install the engine…

Now imagine what it’s going to be like when the government makes your car… coming soon to a dealership near you!