I can’t afford to be a risk taker any more”

…says 75-year-old Margie Alford of Austin, Texas. Yet, Margie’s financial planner is moving her CD money into stocks instead, after fruitlessly waiting for three years for interest rates to rise.

Low interest rates of the past several years have taken a toll on U.S. savers. “The Fed has removed the last shred of possibility that interest rates will revert to normal in the near future,” according to Christopher Carroll, profession at Johns Hopkins University.1

As a result, retirees are taking on more risk… at a time they can least afford to.

With interest rates on CD’s, saving and money market accounts not even keeping up with inflation, what other options do you have?

The Bank On Yourself solution…

When you use the Bank On Yourself method, you get growth that’s typically much higher than you can get from a money market or CD.

Your money grows safely and predictably, without the risk of stocks, real estate and other traditional investments.

A very intriguing feature of a Bank On Yourself plan (a specially designed dividend-paying whole life policy that turbo-charges the growth of your cash value), is that these policies are designed to grow at a steeper pace every single year.

Which means the growth is greatest at the time you need it most – retirement! This also gives you some built-in protection against inflation.

TIRED OF WATCHING YOUR FINANCIAL PLAN GO NOWHERE?

Find out how the Bank On Yourself method can give you the financial security and predictability you want and deserve. It’s NEVER had a losing year in 160 years! Take the first step right now by requesting a FREE Bank On Yourself Analysis.

Wondering where you’ll find the funds to start a plan? Don’t worry! You’ll receive a referral to one of only 200 advisors in the country who have met the rigorous requirements to be a Bank On Yourself Professional and can show you eight ways to find money to fund a plan that can help you reach as many of your goals as possible, in the shortest time possible.

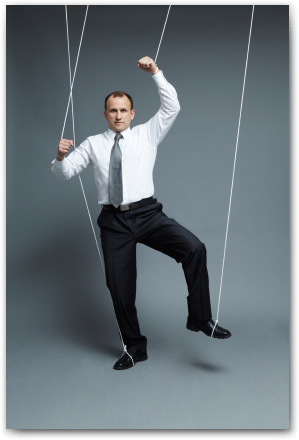

How to avoid the pitfalls of 401(k)’s and IRA’s

Government-sponsored retirement plans like 401(k)’s and IRA’s have more strings attached to them than a puppet. Unfortunately, most people don’t discover them all until they’re already ensnared in a web of strict rules and regulations.

For example, most people know the government won’t let you access your money in the plan without paying a penalty if you’re younger than 59-1/2.

But many people don’t realize the government also forces you to take minimum annual distributions from the plan when you turn 72. And if you don’t obey this requirement “to the letter,” you will have to pay penalties.

It may surprise you to know that one of the most common complaints we’re hearing from seniors forced to take the Required Minimum Distribution (“RMD”) is that they don’t want to take that much money out of their plan!

Why does the government force you to take distributions from your plan when you hit a certain age?

The short answer is, “because they can”!

The longer answer is that the government needs to collect the taxes it let you postpone when you made your contribution.

I read somewhere a shocking statistic about what percent of people aren’t even aware they’re going to have to pay taxes when they start taking income from one of these plans!

The tax time bomb hidden in your retirement plan…

Americans are so easily seduced by a current tax break that many don’t think about the long-term consequences. I mean, did you really think the IRS lets you postpone your taxes out of the goodness of their heart?

The key question you should be asking yourself is…

What direction do you think tax rates will go over the long term?”

If like most people I’ve surveyed you think tax rates will go up, and you’re successful in growing your nest-egg, then aren’t you going to end up paying higher taxes on a bigger number?

So why not pay your taxes now? At least you know what they are!

Also keep in mind that the government can (and does) change the rules on these plans any time they want… for any reason they want.

They can make you wait until you’re much older than 59-1/2 to access your money without penalty, they can require you to take distributions before you’re 72, and they can restrict or deny your access to loans and “hardship” withdrawals.

These are just a few of the reasons more and more people are turning to Bank On Yourself as the retirement plan alternative that gives you total flexibility and control of your money in the plan.

Not to mention that your money grows safely and predictably every year – even when the markets tumble – and you’ll finally be able to answer the question:

What will your retirement plan be worth on the day you plan to retire?”

Knowing the answer to this critically important question makes all the difference in the world. And it’s why many people believe the Bank On Yourself method is the ultimate financial security blanket in both good times and bad.

There are Bank On Yourself programs suitable for almost everyone…

One misconception about the Bank On Yourself method is that only younger people and those who haven’t yet retired can benefit from it. But there are special programs available for folks up to 85 years young.

One misconception about the Bank On Yourself method is that only younger people and those who haven’t yet retired can benefit from it. But there are special programs available for folks up to 85 years young.

Some of these plans allow you to fund the policy with a single lump sum.

However, there are no cookie-cutter, off-the-shelf Bank On Yourself plans. Yours would be carefully custom tailored to fit your unique goals and dreams.

You can easily find out how a Bank On Yourself plan would compare to other retirement plans you may already have when you request a FREE, no-obligation Analysis if you haven’t already done so.

So why not request it today, while it’s fresh on your mind?

Pamela – good info as usual. Meeting w/ Russ on Monday, but I’m wondering how much is being paid on the policies given the interest rates are also so low on bonds. I know the insurance companies use a mix of gov’t and corporate bonds, but w/ rates below 2% for so many of the short term bonds – and even below 1% on some, seems like a tough time to get a real return anywhere, except by paying yourself back at high rates on policy loans.

Just wondering what you’ve seen as far as core returns the last couple of years. And yes I do still get this isn’t purely about “rates of return” as I know the trick that is played with those on mutual funds and the market.

Bill

Most life insurance companies lowered their dividend this year – but the return is still MUCH higher than CD’s and money market accounts, without increasing your risk.

And remember the growth is exponential – your policies become more efficient every year.

It’s not a get rich quick scheme, as you know, but it sure beats the alternatives…

Great article, I just recently got my mother who is 59 to schedule an appointment with your trained advisers this march.

This came about when she had me look at a projected policy some other agent was showing her….when I saw it I could clearly see it was not a BOY!

I asked her if I could meet with this adviser and talk about it…after about a few minutes (and long listening to his arrogant stories) I asked him if his company was a direct or non direct recognition, he said in all his 20 some years experience he never heard of those terms!!! I asked if he knew about BOY, to which he replied no…then I proceeded to show him your book and asked if he would read it and get back to us….to which he shook his head and closed his eyes like a child about to receive medicine, saying he didn’t really like to read at his age!? 🙁

He says he also only sometimes reads things pertaining to his business, to which I replied this book was his business….still didn’t take it.

In the end I told my mother to wait until I could set up a meeting with your adviser……Moral of the story, no matter how many years experience some expert may have…not all experience is created equal…get a second opinion!

I wish I could say this shocked me, Will, but it doesn’t – it’s all too common. Most of those who trash Bank On Yourself on the online forums know nothing about it either (most have never even heard of a Paid Up Additions Rider). And, of course, Suze Orman, Dave Ramsey and the others couldn’t tell you how a Paid Up Additions Rider really works or how dividend paying whole life works or what non-direct recognition means. Yet they have VERY strong opinions about it!

Your Mom is fortunate you caught this in time to avoid a mess!

It is interesting that you push safely grow and protect your money, well us folks in our 70’s and 80’s are more concerned about INCOME…not growth, what can you do to provide us with 6-9% returns, THAT’S WHAT US OLD FOLKS ARE LOOKING FOR!

There are no “safe” or guaranteed financial vehicles that have 9% returns. But Bank On Yourself can safely deliver 4 1/2 – 5 1/2% returns (higher if you’re comparing to a tax-deferred account.

And the growth is exponential – it’s greater the longer you keep the policy.

Why not see what Bank On Yourself could do for you by requesting a FREE Analysis? There’s no obligation to find out.