Here is a list of 7 steps that you can use to help prepare your teens to be financially successful and responsible adults. Feel free to adapt these suggestions to your individual family dynamics.

earn their own income

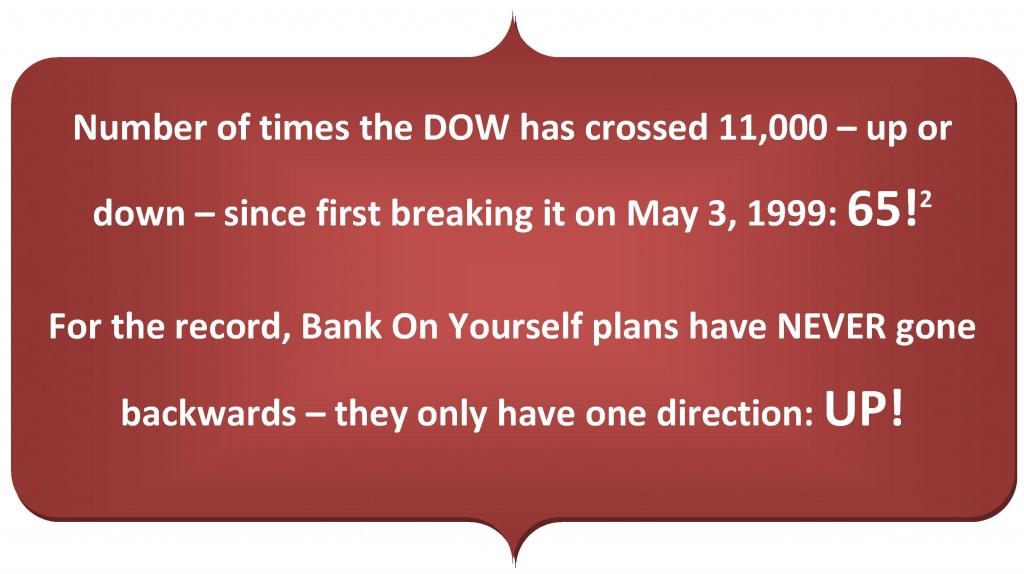

1. Start Bank on Yourself policies for your teens (if you have not already) and/or help them purchase their own policy. You can get a referral to a specially trained Bank On Yourself Professional who will work closely with you to customize a plan that’s designed specifically for your family.

2. Share details of your own Bank on Yourself policies with your children and review both your and their policies every six-months. Show them how you are utilizing your policies to predictably retain and grow more of your own money without paying interest or exorbitant fees to banks, brokerage firms and others.

3. Expose your teens to your full family financial picture – including what you earn, what you spend, what you borrow, and how you invest and save. You may wish to have your children participate by writing checks, reconciling accounts and helping to set and monitor your family budget.

4. Put your kids to work. To truly value money, teens need to earn their own income, whether through outside jobs, entrepreneurial ventures or by getting paid for family chores.

5. Don’t forget charity. Encourage your kids to set aside a regular portion of their earnings and income for a good cause, be it church or other worthy nonprofits. Such gifting will be returned to them many times over in terms of the character it builds.

6. Paint a vibrant picture of your adolescent’s fiscal future – one free from the money worries that envelop so many young adults and their parents. Help teens formulate their own vision of what a life of financial self-reliance and freedom will mean for them.

7. Allow kids to make mistakes and even fail when it comes to managing their own finances. Few adults get it right the very first time, either. Remember, we all learn a great deal from our mistakes.