A review of my book, Bank On Yourself, in the December 2010 issue of the American Association of Individual Investors (AAII) Newsletter declared that the concept is “too good to be true.”

The reason given was, “A life insurance policy loan is not truly a loan. Rather, it is an advance that the insurer must eventually pay out. Worse yet… policy loans can erode a life insurance policy over time.” It also pointed to “potential tax liabilities.”

This review brought to mind one of my favorite quotes…

If you’re looking for an excuse, any one will do.”

– Dan Kennedy

So I wrote the editor and explained there was some misinformation in the review, and that I would like an opportunity to correct the record, pointing out that their motto is “Unbiased Investment Education.”

The editor told me to let him know what I think is incorrect, and he “will take a look at it.” I suspected he was just “humoring me,” but gave him the benefit of the doubt. However, when I submitted my rebuttal, he replied that they would not publish it because “there are no factual corrections to be made.”

I informed AAII I would be publishing my rebuttal on this website, and let YOU decide who is taking things out of context, committing sins of omission, and twisting the “facts”… and who is being fair and unbiased. We’ll pick three of the most interesting, insightful and/or humorous comments made on this blog and award the posters their choice of a $25 gift certificate for a restaurant in your area or a personally autographed copy of my “too good to be true” book.

Besides that, there are several points made in my rebuttal that I have not made elsewhere, so you will find value in reading this (I made it a bit more colorful for your reading pleasure)…

When you take a policy loan, you’re actually taking a loan against your cash value and using your death benefit as collateral for the loan. Should the policy owner die with a loan outstanding, it will be deducted from the death benefit, along with any interest that has accrued.

So, in essence, an unpaid policy loan would be an advance against your death benefit, which in most cases will be far greater than your cash value. With any other financial product, you wouldn’t even have a death benefit larger than your equity to use as collateral.

And what most people (and even most financial advisors and experts) don’t know is that in a dividend-paying whole life policy, both your cash value AND your death benefit grow exponentially, and the growth is both predictable and guaranteed.

Here’s an eye-opening personal example of how this works:

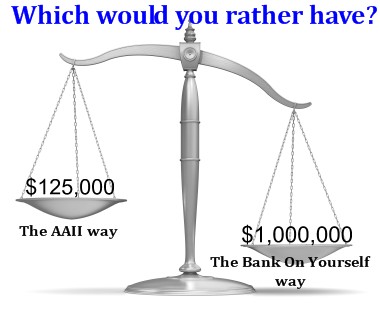

I started a new policy designed to maximize the power of the Bank On Yourself concept a little over four years ago. The death benefit (known as the “face amount”) at that time was $605,000.

Just four years later, the death benefit had grown to $1,104,332 – an increase of over 82%.

One and a half years ago, with almost $125,000 of cash value in the policy, I took a $100,000 policy loan to expand my business. At the time, all my business-owner colleagues were crying on my shoulder about how their bank wouldn’t give them a penny – even those who had perfect credit and long-time relationships with their bankers. They were astonished to discover how I got access to capital by answering just one question: How much do you want?

One and a half years ago, with almost $125,000 of cash value in the policy, I took a $100,000 policy loan to expand my business. At the time, all my business-owner colleagues were crying on my shoulder about how their bank wouldn’t give them a penny – even those who had perfect credit and long-time relationships with their bankers. They were astonished to discover how I got access to capital by answering just one question: How much do you want?

I am in the process of paying back that $100,000 policy loan now. I set my own payback schedule, and I can reduce or skip payments if and when I need to. Try doing that when you borrow from a bank, finance or credit card company!

Suppose I passed away with part or all of that loan unpaid?

My husband would get nearly $1 million, income-tax free. That’s almost $400,000 more than the original death benefit was four years ago! And it’s ten times the current equity remaining in the policy beyond the outstanding loan balance!

Meanwhile, I used those funds to grow my business, and I’ve already gotten close to a 100% return on that investment in my business.

So do you think it bothers my husband that if I die before I finish repaying the loan, he’ll “only” get $400,000 more than the original death benefit, rather than $500,000 more? Or that he’ll “only” get ten times the current cash value?

And can you tell me any other product or strategy that could accomplish anything even close to this result?

Note to Bank On Yourself Blog readers: AAII’s response to this part of my rebuttal was that my statements “point out that the policy can be adversely affected by outstanding loans.” And, thus, “no factual corrections need to be made in our magazine.”

Okay, let’s assume AAII didn’t take this wildly out of context. Their statement that a policy loan “is an advance that the insurer must eventually pay out” is an error of fact. If they already advanced it to you, they don’t have to pay it out again! (Duh!) One problem is that four different people on my team read this statement and each interpreted it a different way. So it wouldn’t surprise me if you do the same.

Additional benefits of the Bank On Yourself method include:

As mentioned in the AAII review, you continue to receive the exact same annual guaranteed cash value increase PLUS the exact same dividend you would receive if you had never borrowed a penny. This let’s you use your money and still have it working for you. And you don’t have to sell your investments to take advantage of this feature.

As mentioned in the AAII review, you continue to receive the exact same annual guaranteed cash value increase PLUS the exact same dividend you would receive if you had never borrowed a penny. This let’s you use your money and still have it working for you. And you don’t have to sell your investments to take advantage of this feature.

Please tell me where else can you get this advantage?

This is true for “non-direct recognition” policies, which don’t “recognize” you have taken a loan when crediting dividends. The policies recommended by the Bank On Yourself Professionals meet the requirements that maximize the power of the concept. These advisors also have advanced training in how to structure policies to maximize the growth of your cash value and minimize the taxes. To get a referral to a Professional, simply request a free Analysis that will show you how much your financial picture could improve if you added Bank On Yourself to your financial plan. You do pay interest on policy loans, and the interest rate is typically below commercially available rates. However, as I explain on pages 100-103 of my best-selling book, the interest paid ultimately benefits the policy owner. You will end up with the exact same cash value in your policy if you borrow from your policy and pay it back at the interest rate the company charges as you would if you didn’t use your policy’s equity at all.

You do pay interest on policy loans, and the interest rate is typically below commercially available rates. However, as I explain on pages 100-103 of my best-selling book, the interest paid ultimately benefits the policy owner. You will end up with the exact same cash value in your policy if you borrow from your policy and pay it back at the interest rate the company charges as you would if you didn’t use your policy’s equity at all.

The AAII review of my book never even mentions a central part of this concept: It is not about just taking policy loans! It’s about becoming your own source of financing.

Key Point

If you borrow from a bank and you don’t pay it back, you’re stealing from the bank. If you borrow money from your life insurance policy and don’t pay it back, you’re stealing from yourself. Once people realize this they become very disciplined and even excited about paying their policy loans back.

If you borrow from a bank and you don’t pay it back, you’re stealing from the bank. If you borrow money from your life insurance policy and don’t pay it back, you’re stealing from yourself. Once people realize this they become very disciplined and even excited about paying their policy loans back.

As noted in the AAII review, there are potential tax consequences to policy loans that are not repaid. A policy that lapses or is surrendered can result in taxes being owed on the gain. As long as you pay the premium and the loan interest, the policy will not lapse.

However, it should be pointed out that defaulting on or renegotiating mortgages or credit card and other debt can result in tax consequences, too. A friend of mine settled $50,000 of credit card debt for 50 cents on the dollar. She got slapped with a tax bill for the $25,000 that was “forgiven.”

Note to Bank On Yourself Blog readers: AAII’s response to this was, “Again, you reiterated what we wrote (about potential tax liabilities).”

Critics of whole life insurance will be surprised to learn that I had $125,000 of cash value in that policy when the policy was only 2-1/2 years old. They might be even more surprised to know that I had tens of thousands of dollars of cash value at the end of the first year.

Critics of whole life insurance will be surprised to learn that I had $125,000 of cash value in that policy when the policy was only 2-1/2 years old. They might be even more surprised to know that I had tens of thousands of dollars of cash value at the end of the first year.

That’s because policies designed to maximize the power of the Bank On Yourself concept have riders incorporated into them that significantly increase the growth of the cash value. You could have up to 40 times more cash value in your policy in the early years than you would in a traditionally designed policy (the kind most experts and advisors talk about), as explained in Chapters 3-6 of my book. This allows you to use your policy as a powerful financial management tool right from the start.

(Note: No two policies are alike – each is custom tailored to the client’s unique goals and situation. To find out what your bottom-line numbers and results could be if you added Bank On Yourself to your financial plan, request a free Analysis here, if you haven’t already done so.)

The review ends by saying that “loans, when necessary, should be taken out separately from your portfolio.”

This ignores a basic, but often overlooked principle of economics:

You finance everything you buy! That’s because you either pay interest to use someone else’s money or you give up the interest or investment income you could have earned, had you kept your money invested instead.

The Bank On Yourself concept can beat financing, leasing and even paying cash for things, for the reasons described above.

One final comment on this review: It refers to whole life insurance as a “portfolio,” which implies it’s an investment. It is not and is not subject to the ups and downs of traditional investments. Dividend-paying whole life insurance is an asset that has increased in value every single year for more than 150 years, including during the Great Depression.

The Bank On Yourself method gives you a financial foundation that can help you weather tough times, access to capital when you need it on your terms, it allows you use your money and still have it working for you, AND it lets you grow a nest-egg you can predict and count on.

That is what most of my book is about. I wonder why none of this was even mentioned in this review?

So, is Bank On Yourself “too good to be true”? I hope you’ll decide for yourself with the facts at hand.

Note to Bank On Yourself Blog readers: The AAII says that it stresses “hands-on participation in your financial future through education and understanding,” and that, “our reporting is unbiased and we are not beholden to anyone.”

Coincidentally, an article appeared in the Wall Street Journal 1 this week that noted that AAII surveys its members each week and that “some investors have looked to the AAII survey as a compelling contrarian signal. An ebullient reading often is a clue that the market is due for a fall.” Translation: AAII members tend to move with the herd and buy and sell at the wrong times.

Why am I not surprised? And, given this revelation, I realize we should be concerned if and when AAII endorses Bank On Yourself.

We want to hear from you! And the best comments will win prizes…

Did the AAII review of my book twist things, commit sins of omission, and take facts out of context… or was it fair and unbiased? Speak your mind in the comments box below. We’ll pick three of the most interesting, insightful and/or humorous comments and award the posters their choice of a $25 dining gift certificate or a personally autographed copy of my “too good to be true” best-selling book. (To qualify, you must post your comment in the comment box below by Monday, January 24.)

Check out the most interesting, insightful and humorous responses we received.

The AAII has an interest in encouraging people to buy and sell traditional stocks and bonds, because traders need frequent updates that AAII can provide. The AAII has no interest in people taking an approach to personal finances that is to their personal benefit, but that does not require frequent updates regarding conditions in the financial markets.

Bank on Wall Street or Bank on yourself…a very simple decision…Dan

Wait…Hold the press’s!!! You sent an article to the American Association of Independent Investors and they said “too good to be true?” LOL That shows how many closed minded Investors there are…They wouldn’t know an investment if it GAVE THEM A CHECK. Why do you think most investors make 3-5 percent over the course of their Live average. First what they need to realize is Major BANKS use a similar policy like Bank on yourself. They are called BOLI (bank owned Life insurance). IF BILLIONS ARE PUT IN THESE FUNDS don’t you think it is a good investment? The news letter is “unbiased” because they don’t have the knowledge to be biased.

As far as being Taxed…IRS states in publication 525 “Life insurance proceeds paid to you because of the death of the insured person are not taxable unless the policy was turned over to you for a price. This is true even if the proceeds were paid under an accident or health insurance policy or an endowment contract. However, interest income received as a result of life insurance proceeds may be taxable.

A loan is not Interest, so that is exempt as well. You want an unbiased review…”TWO THUMBS UP ” From me..a loyal policy holder…we don’t need no newsletter to tell us what we have.

One of my favorite benefits of my BOY plan is its flexibility and freedom from government regulations. If you invest in 401(k) or IRA retirement plans or 529(b) college savings plans, there are many restrictions on when and for what you can access the money you have invested. The BOY plan has no such restrictions; I can access my cash value whenever I want as a loan and use it for whatever I want without Big Brother looking over my shoulder. I don’t pay taxes on it or early withdrawal penalties, either.

My BOY plan consolidates my emergency fund, liquid savings, retirement and life insurance into a single, flexible vehicle. This makes it really easy to manage my money!

“Unbiased Investment Education”. This is the ‘bigoted’ lie that I and so many others swallowed for far too long. I’m glad I swallowed my pride 18 months ago and listened to ‘the sound of the trumpet’! Thank you, Pamela, for sharing the ‘truth’ with those of us who wish we’d understood a long time ago!

BTW: It’s working just like you said it would! I have proof after just 1 year!!

Derek

My “Bank on Yourself” advisor is in the process of creating a plan for my wife and me, but even on the front side of my own plan, the comments forwarded by AAII sound like they were drawn from the good o’le boy tank of sour grapes. I’ve been well acquainted with whole life insurance and other products for years, having been involved in financial planning myself much earlier. Due to the typical construction of whole life policies, I never recommended them. Without the benefit of the dividend premium riders offered now, the cash value by definition was no more than “a partial return of a deliberate overcharge”, which for the first two years went to commissions for the agent. The challenge with buying term, and investing the difference was that very few investors, and perhaps fewer advisors, knew where to put that difference where it didn’t result in a total loss, or at least a partial one due to low returns. I’m excited about the program, which has provided a much needed transition to a vehicle that is safe, predictable, and provides not only a solid nest-egg for retirement, but also a funding pool over which I have complete control. I’ve seen nothing else that allows you have your cake and eat it too.

If AAII were interested in objective commentary, they would go back to the drawing board and start over with some basic honesty and open-mindedness..

Pamela,

There is a lot I do not know or understand, that is a given. I watched as my 401K declined by over 30% between 1999 and 2001. After retiring in 2007, I moved what remained of those assets plus my government Thrift Savings Plan into an IRA only to see that plan loose 40% in 2008. Call me crazy, but I followed the advice of those who are paid to know and each time “rode it out”.

I do not want to go though any more of these “cycles’, so I am now in the early stages of learning about Bank on Yourself. I am working with an adviser who is guiding me through the process and plan on purchasing a policy very soon.

The motivational factor is that for the first time I will have something that I can control, that will benefit me and my wife, and will increase in value over time.

now, there are other investments which will increase in value over time, but do not have the flexibility of a Bank on Yourself policy.

After losing so much money in the past, I am looking forward to even a small increase in the future but especially not losing any more!

Bill Williams

I understand why people are skeptible, every time I try to explain the concept to an insurance agent or some financial adviser they don”t get it and don’t want to understand it, thats their problem! I read your book and also R. Nelson Nash’s book and I studied it and studied it then I bought a policy! My policy was less than two months old and I borrowed $20,000 on it. I”m in the process of buying another one. To me its the only sure thing from a financial standpoint that I can find. I tried to buy a policy on myself, but they turned me down, I’m 72 years old and I saw it as a way to leave over a l,000.000.00 to my estate, oh well. So the policy I bought was on my 35 year old son. I have 5 children and l6 grandchildren so I have plenty of investment potential.

We are delighted with our BOY policies, since we will be looking forward to borrowing from some of them next summer for a cabin and college tuition, and possibly a car.

I’m glad you revealed this about AAII – I had a membership application sitting on our table, and was intending to join. Due to the “contrarian indicator” effect of AAII’s member surveys mentioned, and to the closed-mindedness of the organization to even print your response and let its members decide, I have decided that AAII is not for me.

JC – I think that’s what they call “pay back”!

This is obviously the age old territorial battle. They do not want to endorse people towards life insurance or annuities, as Wall Street is out of that game. Where do you think the billions of $$$ in profits that come out of the major Wall Street firms comes from? Yes, that’s rhetorical! It comes directly out of investors pockets through management fees, 12b-1 fees, annual maintenance fees, etc. It reminds me of a great book–“Where are all of the customer’s yachts?”

In general, the individual investors is slowly and methodically getting fleeced, which is bad. What’s worse, though, is that they are blind to the fleecing. See any rolling period Dalbar study to prove this. It’s a shame.

The AAII ‘helping’ individual investors is kind of like saying AARP ‘helps’ seniors. Years ago that was its intention. Now it has been taken over for profit motives–advertising revenue, insurance commission sharing arrangements, etc. The AAII is running under he same guise. They occasionally have a tidbit or two, but the rest of the iceberg is under the water.

Best Wishes to y’all from Texas…Jake

[…] This post was mentioned on Twitter by Pamela Yellen, Pamela Yellen. Pamela Yellen said: The gloves are off! Do you think AAII is twisting things and taking them out of context… or being fair and unbiased? http://fb.me/Ns1ZpT3V […]

Is anyone really surprised, It’s the fox guarding the chicken house. The blind leading the blind, The king has no clothes.

“While claiming to be wise, they became fools.”

Hey I just started six months ago, with a back-date six months before that–and just took a loan out for $29,000. in case I need it for a downpayment on a new condo. Compare that with the hassle of taking money out of a 401k. AAII may represent equities fairly, but it appears that they didn’t even understand the points you made because of their perceptual bias. Or, as Emil stated above, their newsletter has a financial incentive to ignore alternatives to traditional investment vehicles.

Typical response, remember the highest form of ignorance is rebutting something you know nothing about.

Go get ya some, Pam

Well, I had subscribed to AAII at one time several years ago, but my eyes always glazed over trying to submerse myself into their data. Really, I got nothing from their periodical. I have an investment real estate professional designation which I earned through a lot of hard work, but trying to make something worthwhile out of AAII never happened for me.

Regarding your rebuttal, I only have one thing to say. SHHHH! If too many investors discover this approach to preserving wealth – and accumulating wealth – then the tax laws, which make Uncle Sam an integral part of this plan, will change.

The only thing they could change is the taxable portion of death benefits received from a life insurance policy. And that all gets very complicated.

Life insurance premiums are not tax deductible, so therefore they can’t tax you on your investment in a life insurance policy (you’ve already been taxed on that money).

Any dividends you may receive are taxable when withdrawn.

Loans, as we all know, are not taxable simply because they will be paid back with money you will pay taxes on. Bear in mind, however, if you don’t pay that debt, you can receive a 1099c (for cancellation of debt) that you will have to include in your tax return and will be taxed for.

You’re partially right, Susie. Dividends you withdraw aren’t taxed until they exceed your cost basis, at which point you can switch to borrowing your cash value with no taxes due on policy loans.

Also, there is no IRS reporting required for unpaid policy loans, because they are deducted from the death benefit, if a policyowner dies with a loan outstanding.

Different rules my apply if you lapse or surrender a policy.

Pam, I’m surprised you didn’t get your friends and colleagues on board with BOY. I can totally understand the difficulty in getting a business loan from the commercial banks the past two years.

Tim – I share the concept with all of my friends and colleagues. A mentor of mine told me you’re never a prophet in your hometown, and there’s some truth to that.

But the good news is that many of my friends and colleagues HAVE followed through and are immensely grateful for that.

You state that AAII followers tend to move with the herd and I guess that would make AAII the ranchers who view their members as cattle to be fed and then led to slaughter. Do you think they measure themselves on how well those investors do? Do they have annual reviews with their members the way a BOY advisor does? Do they ever go outside the herd and be a contrarian? I have a friend who has given me the label of “obstinate contrarian” – and I view BOY as an example of how that is an awesome thing. AAII – American Association of Idiotic Investors – may be a bit harsh, but I don’t want to led by the ranchers to the slaughter for my financial future, I think I’ll set my own path and use BOY as a foundation for that.

Thanks Pamela and keep up the good fight

Your rebuttal of AAII’s review is “right on.” Keep up the good work.

I joined AAII a few years back because their publicity made it sound simple and profitable. But when I got their newsletters with investment recommendations, they left me in a fog. After a few months, I just ignored their mailings because I was getting absolutely no benefit from them. Perhaps others have had good experiences with them and I am judging them too harshly, but that was my experience.

I just paid my premiums today for my first BOY policy and I am tickled to death with the simplicity behind the concept. Because I am 73 years old, I rolled my 401(k) and my 2 IRAs into an annuity IRA and, because I do not need the RMD to live on, I will use my RMDs to pay off the loan I plan to take out on the BOY policy as soon as I am able.. My plan is to use my loan to invest in gold and silver. That way my money can be working for me two ways at once and I will be adding to the value of my BOY policy at the same time..

Thank you,

Val

I’m 26 years old, and I have not figured out everything but I have figured out a few things: if I work hard every day and I save some money I’ll be just fine.

Another thing I have figured out is that if you leave your money with Wall Street, they’ll end up taking it all. Somehow!!! They get their commission whether you gain or lose.

So, here is to Banking On Yourself!

Pamela,

First, thank you for sharing this great product that the rich actually use to great effect. I’m not rich, but have still been using it for a few years. Its everything I expected it to be after asking lots of questions.

It seems that the facts AAII states are not incorrect, but I fail to see anything bad about them. They may have failed to define what they meant, but that is up to the reader to delve deeper.

Its not much different that what you hear on the news or read in the newspaper.

AAII naturally committed the typical strategic blunders essential to the charade proposed by the investment industry (Wall Street) and financial professionals (a.k.a. traders, gamblers, speculators, etc.). Any attempt to allow people an opportunity to truly grow wealth, reduce risk, and prepare for a more stable environment challenges the status quo of buy and lose (commonly referred to as buy and hold) and then industry pundits (AAII) start the negative attacks in order to establish fear of finances and preserve their base of profits. AAII omitted important aspects of your plan, distorted facts of your plan to promote obfuscation, and blatantly twisted all aspects of your plan in order to destroy your credibility.

Thank you for presenting people with an opportunity to actually prepare, plan, and realize a better financial picture. I will definitely request an analysis and meet with an advisor when my financial situation stabilizes in the not so distant future.

I am sincerely impressed with your intent to ensure a bright financial future for the ordinary average working person.

After having a BOY policy for 2 years, I`m happy and plan to take a loan from it. The appearance is that it will work quite well and be true.

All I can say is this (IMO)…. They (AAII) must be eating dog food or smoking dope!

I am in the process of purchasing my first BOY policy. I feel I still have much to learn but what I understand at this point is that at age 59 if I had known about this program even 10 years ago I may be looking at retirement instead of working an additional 8-10 years. Yes, I have a financial advisor and I am a very disciplined investor in my 403b and yes I rode out the downturns and have not nearly recovered to this point. My husband is 15 years older than me and is retired and thanks to traditional investing we may never be able to retire together. I am thankful I found BOY otherwise I may never see retirement in my future

Hi Pam,

I haven’t joined “Bank On Yourself” yet, but I do have an appointment with one of the advisers next week to start my free analysis. From what I have read, including this blog posting, I can’t see why any clear thinking person wouldn’t be eager to start “banking on themselves”. I’m also certain why you’re getting the reception you are from organizations like AAII, and any others that are affiliated with Wall Street; it’s because you’re a threat to their source of income. I’m in your corner and with you 100%. Keep up the good fight!

Steve

I purchased and received several BOY books and handed them out to many friends and family. Not one person has started a policy under BOY yet and I hope they do soon. Yes, it does sound like a “too good to be true” deal and that could be why. I did a lot of research in the BOY concept before even getting in touch with an advisor. I read the concept over and over and over again to be sure I knew what I was reading and to be sure I understood it enough to find out more information. I’m not the brightest person in the world, but I do know BOY is a for sure thing. As with many other people who have a BOY policy, it’s the best money investment I have ever made in my life.

My BOY plan has saved me a lot of hassle, frustration and money when I needed a loan to replace a transmission on my car, pay off medical bills, purchase a much needed storage shed and actually buy a used car. It has helped me in other ways after getting my income reduced from work. Unlike a bank loan, I set up my own payment schedule and set up how much I can afford to pay back every month and when I want to pay it back. Like Pam has said, it only hurts ME if I don’t pay back my loan, rather than having to deal with collectors.

Until a person gives a little bit of money or a lot and puts it into starting their own BOY policy suited to their needs, they really do not have any idea how much they will BENEFIT from it!!!

It would seem that AAII is like most of the supposed “unbiased” reporting out there…i.e., they only report what THEY want you to hear. On the surface, it would appear that they “picked and chose” various tidbits of the BOY Plan and not the plan as a whole. They are doing their readers a dis-service by NOT presenting them with the entire picture to make an informed decision with ALL of the facts. As stated earlier above, you are absolutely correct when you say that we should all be worried the day they actually did endorse BOY!

Amen to all the comments! I’m on the low end of middle class and my hard earned dollars have always lost money with any commodity/stock/bond type investment. I have never had a gain except with a CD and that barely kept up with inflation. My BOY gives me such security. I can sleep at night. It reminds me of “It’s a Wonderful Life” — we are all banking on each other (instead of padding corporate executives lifestyles). Some of my investment is in ‘Martelli’s house’. But I can trust my fellow BOY investors and we all profit from it. People hope to win the lottery. I just hope to find a few more dollars to have babies in my BOY policies (‘mama dollar and papa dollar’).

Just the other day a study came out saying the first couple of years in college the student’s progress very little. In fact, it is more of a time to work on your social skills. Therefore, I am not surprise when a group of professionals cannot look at a different concept and take it for what it is. A simple plan that gives the owners of their BOY plans the right to use there money when they need it. The professionals did pay a lot of money for all of their degrees and financial knowledge. So they must be right in their minds because…….well it cost a lot of money……and they should stick together….because if more people do this it will make them look not so good…….and my favorite thing they say is you should diversify in the market……because if this doesn’t work you will be protected because you will not have all your eggs in one basket…..and how about we cannot based results based on past performances…..You have to learn how to become your own Bank take control of your money. I have a BOY policy

Thanks Pamela

Von

Pamela, I read AAII’s comments and smiled the whole time. I can’t say I’m surprised because they have been steeped in traditional thinking. The see investing through the lens of their experience and they never question the lens. I was laughing while reading because it brought to mind two quotes from one of my favorite authors, Stephen Covey:

“He, who is good with a hammer, sees everything as a nail.” and…

“Fish discover water last”

You have identified AAII for what they are, very biased and stuck in their own paradigm of traditional investing. Perhaps when this blog becomes the defacto standard for real EFFECTIVE investing advice, they might want to buy a clue. Of course, they will have to take a loan from their 401K, which would decrease their equity and have significant tax consequences if they are not 55.5 years old. Hmmm, maybe they won’t buy a clue then. Thank you for all that you do.

Mark

I am Debt Counselor in a Nonprofit Org for Hispanic community in South Florida. (Miami).

And imagine if people that were born here don’t get it…. We, including myself I am from South America. We are very uneducated to the American Financial System.

But for the last 2 years of my life after eliminating debt on many families, which I still, do as a community service.

I want to advise, help people that have money and don’t know how to use it.

Many families give out 20% of their income to wrong tax and interest…

BOY is a great concept that makes us think.

Luis Maqueira

This reminds me of one of my all time favorite movies “The Three Amigos”. Below is the dialog between the infamous (in – famous = more than famous…those that have seen the movie get this inside joke) El Guapo and his cohort Jefe about his piñatas. AAII represents the infamous El Guapo who twists things to make himself feel superior:

Jefe: I have put many beautiful pinatas in the storeroom, each of them filled with little suprises.

El Guapo: Many pinatas?

Jefe: Oh yes, many!

El Guapo: Would you say I have a plethora of pinatas?

Jefe: A what?

El Guapo: A *plethora*.

Jefe: Oh yes, you have a plethora.

El Guapo: Jefe, what is a plethora?

Jefe: Why, El Guapo?

El Guapo: Well, you told me I have a plethora. And I just would like to know if you know what a plethora is. I would not like to think that a person would tell someone he has a plethora, and then find out that that person has *no idea* what it means to have a plethora.

Jefe: Forgive me, El Guapo. I know that I, Jefe, do not have your superior intellect and education. But could it be that once again, you are angry at something else, and are looking to take it out on me?

Of course we all know what a plethora is. It’s just that AAII twists meanings and wants its readers to believe that you don’t know what you’re talking about because they are mad at something else and are looking to take it out on you.

Just my two cents Amigo.

P.S. I too used my policy to expand my business here in the last few months when no banks weren’t and still aren’t lending money and have had similar results with my return on investment.

Ahhhh, Well let AAII say what they may…But I know what my retirement will look like. Besides, they AAII and their employees are looking to commissions not helping people with finances. I would say they are like everyone else who is thinking “in the box”.

I cannot wait to start another policy myself. Keep up the great work Pam

Sincerely,

David

My wife broke her wrist in September; we have only been participating in Bank on Yourself for less than a year. We were able to borrow enough to get us through the Surgery, the therapy, and all the physicals that were needed to allow my wife to get back to work. As we sit here snickering we know that we don’t need AAII to tell us what was or is not a good investment. Dad always said, “You can lead a horse to water but you can’t make him drink.” I guess there minds are too closed to the other possibilities. Thanks for bringing this in to our lives…

My only regret is I wasn’t able to move my Vanguard 401k money to BOY!

Hi Pamela, the mantra for all good investor is – have an entry and exit strategy for all your stocks. Fine and dandy except there are more mutual funds companies then stocks on the NYSE. In addition, there is no exit plan when you enter into a mutual fund program. Moreover, mutual funds are nothing but a basket of individual stocks. And when you enter into a 401K program, you are buying into a group of –you guessed it! — Mutual funds, well mostly. And there is no exit plan. And the AAII claim to be the biggest investor club around. And do they have an exit plan? I’m learning still–do you homework–no one cares about your money more than you. Mahalo!

AAII is an oxymoron, giving financial advice on a product they obviously know very little about and they wouldn’t invest in because they they couldn’t claim to be unbiased. I’d say with their record, it’s a good thing they didn’t recommend BOY.

CYA…It’s Cover Your Assets time for traditional investors. Like everything else, investing has changed.

…and I’ll bet you thought CYA was referring to something else…

How can you tell the difference between a BOY user and an ordinary person?

The BOY user can buy a business with the BOY policy loan, and the other non BOY can work for that business.

Speaking of that, it would make more sense to promote this as a way of stimulating the economy via BOY. Wasn’t it said that most of our economy is in the “small” business area? Isn’t that the backbone of commerce?

I wonder how many jobs were created by BOY users when others were laying off employees because they could not get financing?

Sounds like a new idea, perhaps F.A. Hayek is alive and well through BOY.

By the way this sounds like a great way to start franchises and not only buy cars or houses….what a concept…work 5 to 10 years hard through boy, buy a business, employ, grow, and laugh all the way to YOUR BANK!

“To good to be true” The truth has never changed in our universe. Non-direct recognition is the “business world’s word” for VELOCITY. Velocity is an eternal LAW of physics. Note: that velocity is a vector, with properties of magnitude as well as direction. VECTORS can be added together!! When we use our “cash value” — we double the use of the finances, when the investment makes money — then the same dollar is making more money for us at the rate of 3 fold. What is your “rate of return” at 3 or even 4 to 5 fold?? I like Pam started a 625,000 dollar policy in 2004; after I lost 80% of my retirement account; which is now valued at over 1,000,000 and 183,000 cash value. I have taken 9 loans out; from these investments — I have real retirement now; and with investments making more investments. instead of the QUALIFIED people making all the money off my hard work. YOU REALLY CAN’T EXPLAIN THIS TO CLIENTS —- YOU HAVE TO ‘S-H-O-W’ THEM. When you show them investment by investment — then they learn the meaning of ‘FINANCIAL VELOCITY’!!!

Yes, the old adage, “If it’s too good to be true, it probably is.” In the case of BOY, it is true. The negativity is just more ignorance from the lemmings. I’ve been putting money away for 20 years into 401k’s and IRA’s. We haven’t lost most of it in spite of the market down turns mainly because I pulled most of it out before the market tanked in 2008. Yes, it grows during the bull markets, but I loose more in bear market years. I can’t depend on it being there in the end. We started 2 BOY policy’s in 2009. After a year they are both right on for the projected non-guaranteed cash values. In 7 years the cash value will be equal to what we invested at this rate, and just grow from there.Not to mention the growing death benefits that are there if one of us passes. Can the stock market equal that return? Maybe, maybe more, maybe less. You just don’t know. Can I get my 401 and IRA money out tax free? No. Can I borrow from them with total freedom like I can from our BOY policies? No. Will I earn dividends on the borrowed money from the 401 and IRA’s? No. Is there a death benefit worth 4x or more the cash value? No. BOY has all that including paying dividends on borrowed money. What’s not to like? Yes, a lot of the premium goes to paying for the life insurance in the beginning, but this is a long term deal.

Where else can you buy life insurance and in 7 years get all your money back and still have a bigger death benefit than when you started, and use that money as your own bank? Tax free?

The problem as I see it, is lousy whole life policies and salesmen in the past that soured people on the concept. People don’t want to open their minds to the differences with BOY and all it has to offer.

Pamela,

WOW! After reading all the glowing posts about the B.O.Y system, I’m afraid I may have a different viewpoint. I set up plans for me and my wife and we recently received out first annual reports. But I hate to inform you, it’s no dang different!! Yes the policy loans need to be paid back. Yes interest is paid as well. And just like those typical “FAT CAT” bankers, my B.O.Y banker is using MY MONEY to buy fancy cars, take exotic vacations and do all the other fun stuff at MY EXPENSE. And he’s probably socking away tons of MY MONEY for HIS RETIREMENT!!!!!!! Oh wait a minute. THAT’S ME!!!!!!!! Never mind.

As for AAII, GO GET EM TIGER!!!

Jim Vana

It’s amazing how many closed-minded “experts” and “advisors” there are out there. I hear them and read them all the time. I just am closed-minded back at them, because I know better now!

By the way, Pamela, I was pleasantly surprised to see you and your book quoted several times, and favorably so, in my December issue of The Franklin Prosperity Report. Guess they’re open minded enough to publish the truth when it’s presented to them!

They say you can lead a horse to water but you can’t make them drink, and that is so true when trying to get people to grasp the principles behind BOY. To many people listening to people like Sue Ramsey. Although I do agree with some of their thinking there will be plenty of stupid tax paid on their investment advice.

Pam,

The “Good Old Boys” are hanging together again. As another reply mentioned- they have a vested interest in a person “not” managing their own finances. They defend against a concept that works and they are afraid of “business” they will lose when people catch on and start using BOY more extensively.

How easily people forget the lessons of history. Our ancestors survived the Great Depression by using Cash Value Life Insurance and Fixed Annuities. They didn’t use the “investment” vehicles touted by so many. Those had all been rendered worthless. They relied on their own “cash assets” – the asset class so often overlooked today where all else is in flux.

And… does AAII ignore the fact that other loans must be repaid with taxable and probatable cash from elsewhere in the estate? Death doesn’t cancel debt!

I think these folks need to read, comprehend, and digest the strategy presented instead of being so hasty to “kill” an unbeatable concept.

By the way: Where is their submission to your $100,000 challenge???

The AAII newsletter sounds like every other financial newsletter I have ever read they talk like they know it all but never publish anything concrete. BOY is a life saver, we use our policy to buy everything, from our boats to repairs for our rentals, it is great to have a way to borrow money when needed, pay it back, borrow it again, and watch the cash value continue to grow. We are always surprised how much our policy grows every year and best of all it’s always TAX FREE. AAII won’t publish your rebuttal because they challenged a giant and got crushed. Keep up the fight Pam and Thank You for educating all of us that there are some things that are “too good to be true”- BANK ON YOURSELF.

Classic (& tired) example of a quote (take yer pick) by Will Rogers. Let’s come up with all the excuses that people really are using when they say “too good to be true”. #99 – …”OMG i like SO heart my iPhone LOL”. We see what we wanna see…negatives (the ‘bad’) with things we don’t understand, and positives (‘good’) in things that we’re comfortable with.

On AAII’s comment about loans, I don’t understand the “must pay out”, so yeah, sounds kinda “DUH”. But I smile when he says “it’s not truly a loan”….exactly dude, if by “true” loan you mean borrowing from & repaying someone else.

About the “tax liabilities”, maybe as with the loans he’s speaking of “true” liabilities. Us silly BoY’ers. I guess we should really be more concerned about tax liabilities than liabilities that we can actually control. The reviewer probably “invests” in traditional IRA’s and 401k, and tells those in a higher (or lower!) tax bracket that their income is a tax liability.

Well, I gotta go put some green paper into Bank of America, and some into The stock supermarket. “Real” banks are safe, and the market will get me at least 12% this year. Besides, life insurance as a BANK just sounds weird & crazy anyway!

PS – Jim Vana….awesome!

The world totters on the brink of internationally consensual investment implosion, whilst another pretender to the throne of investment wisdom preaches out of ignorance so as to protect its turf. The investment community is very fortunate that the masses in this country and abroad are enamored of the “normalcy bias”, a quasi-innate human affliction that implies that everything is fine and normal, and all these dastardly, negative warnings of economic doom should not be of any concern. Nothing bad could happen here. The fact that the nation is in denial is irrelevant.

Wall Street pays no attention because they are compensated whether you win or lose. The Federal Reserve, a private bank with no reserves, works in collusion with the banking industry, condoning fractional reserve banking…printing money out of thin air. In fact, this trio hopes the masses never come to their senses. Has nothing been learned from the last fiasco… a work still in progress?

Investments are games of chance catering to the gambling mentality of the greed factor. BOY is not an investment…rather a financing tool that allows proven, safe, guaranteed growth and control. With your personal “bank” you reap the rewards of the banking industry formula, while remaining personally accountable to yourself and morally in tune with the concept of common sense. Boy will continue to work as it always has; it can’t be refuted.

The smug investment community is in for a rude awakening. Mere mortals take note…there’s an ill wind blowing. Nothing is normal anymore. All asset classes are subject to risk. What of the normalcy bias when the Zimbabwe curse descends upon the fiat currency of the U.S… the reserve standard of the world? Prudent “investors” may find it difficult to purchase a loaf of bread with a Krugerrand and expect the baker to make change. Major investment risk is imminent. Personal financing that you control…not so. Stay tuned.

Ok look. Pamela, if you had a policy that started with a face value of 600k that grew to over 1 million in only 4 years, the only way to do that was to heavily over fund the policy. Plain and simple. There’s no magic and most investors don’t have that kind of cash. There are also restrictions on how much you can over fund a policy too so one must be careful so that the policy doesn’t become a MEC and subject to penalties. Oh, and if you took a 100k loan out against the policy and immediately used that money for something, you better have an additional 800 to 1,000 a month to pay back the loan with on top of your premium. Or else you will run the risk of the insurance costs eating up the cash value and policy lapsing.

You also fill your book with entirely made up scenarios of how people end up buying 6 or 7 policies. Look, each of those policies are probably going to cost $400 to $500 each to fund which would total around 3k of extra cash each month to put into the policies. If I had an extra 3k per month of cash lying around to dump into any investment I would be quite happy. But, I don’t. These policies are not cheap and you have to overfund them at least some for it to work.

You also have to remember that this plan is not going to work well for those with health issues who have to pay higher insurance costs. You never talk about that. It’s assumed everyone is healthy.

The other selling point I don’t like about BOY is how it’s implied that you pay yourself back the interest on any repaid loans. That is not true. The loan interest on any life insurance policy is going to the life insurance company and not back into your cash value.

Let’s also look at another point that is never addressed. That is that if you want to keep the policy active, you will NEVER have access to 100% of the cash value. Yes, you can take loans and access some of it but never ALL of it. If you also want to stick with your “plan” you should keep up your normal monthly payments along with an amount to pay back the loan in a timely manner. Let’s say I’m paying $500 per month in premiums and then I need to pay back an additional $300 per month toward the loan, I am now paying out $800 per month from my available monthly income. If you don’t stick to your plan, it won’t “grow” like you want and you could be in risk of the insurance costs eating up the cash value. Remember, the insurance costs inside the policy will increase over time as one gets older.

If I save money to buy a car using a savings account and then buy that car with cash when I have enough money, I may want to continue to save like I was but I’m not required to if my finances get tight. With a BOY plan, one must be disciplined and keep it going for it to work the way it is supposed to. That initial 5 years is very crucial and probably when most policies are allowed to lapse. I would like to know how many BOY customers end up letting their policies lapse? Any stat’s on that?

It seems to me this “idea” also has flaws and is “too good to be true.” Maybe it is also for those already with a good amount of disposable income and not for us average folk trying to do our best with our limited income.

Let me attempt to correct some of the numerous misconceptions contained in your comment:

1. All Bank On Yourself-designed policies are “heavily over-funded,” whether the premium is $1,000 a year, $10,000 a year, or $100,000 a year. This is done by incorporating a Paid Up Additions Rider into the policy.

In addition, all Bank On Yourself-type policies have a death benefit that increases exponentially over time.

2. Your statement that “most investors don’t have that kind of cash” does not apply, because each Bank On Yourself policy is structured to the client’s unique situation, cash flow, etc.

3. The premium you pay for your Paid Up Additions Rider is optional.

4. The Bank On Yourself Authorized Advisors have software that enables them to structure the policy so it avoids becoming a MEC (Modified Endowment Contract).

5. If you take a loan, there is no requirement to pay it back right away, and no requirement to pay back “$800 to $1,000 a month,” unless you want to. And if you purchase something with a policy loan, and can’t afford to pay it back, you weren’t in a position to buy it (barring a change in your circumstances) in the first place.

6. My book also contains stories of people who only have one or two policies. Over time, however, many people start additional policies as their income and cash flow grows, in order to reach more of their goals.

7. If health is an issue, someone else can be the insured. What’s most important is simply that you own and control the policy, not necessarily that you’re the insured. And people who do start multiple policies often use different family members as the insured.

8. As explained on pages 100-103 of my best-selling book, you will have the exact same cash value if you borrow against your policy and pay it back at the interest rate the company charges, or don’t borrow from it at all. So, who is the interest benefiting if not you?

9. You are correct in that the company won’t let you borrow 100% of your cash value and that’s to help prevent your policy from lapsing, which is a good thing!

However, your cash value will ultimately equal your death benefit, which means that you (or your loved ones and estate) DO ultimately get ALL your cash value.

10. The policies designed and implemented by Bank On Yourself Advisors have an exemplary persistence rate – very few lapse.

11. You keep talking about “average” people not being able to do this. But this website and my book are full of examples of people of all income levels who use this method. (One commenter on this blog post describes themselves as “lower middle class.”) I’m still trying to figure out what book or website you were reading to conclude you have to be wealthy to implement this.

Which leads me to think you are going to believe whatever you want to believe. Because you seem so determined to find fault, I do not believe Bank On Yourself is appropriate for you.

I’ll admit I haven’t read the article “too good to be true”, but I offer this observation based on one critical comment regarding policy loans and the reality one of my clients experienced:

Taken from your blog —

So, in essence, an unpaid policy loan would be an advance against your death benefit, which in most cases will be far greater than your cash value. With any other financial product, you wouldn’t even have a death benefit larger than your equity to use as collateral.

—–

Not only is there no death benefit as collateral in other investments, but as my client found out, the hard way, with a Hypo Loan from his Major Brokerage House account, he was forced to sell some of his holdings, at a loss, to satisfy his Brokerage House. This reminds me of a quote: “A banker is someone who will lend you their umbrella when the sun is shining, but will quickly ask for it back when it starts to rain.” Please forgive me for not remembering who made such a profound observation. Last I checked, whole life death benefits (the collateral against a policy loan) don’t go down. I guess AAII feels it is good practice to help people use unpredictable and risky assets as collateral for loans.

There is the school of hard knocks and there is the school of common sense.

Excellent insight, Chuck. As I pointed out, you don’t have to sell assets – ever – to access your capital – I know of nothing else that gives you this advantage. It was Mark Twain who said that quote.

Pamela,

What rebuttal do you have to, ■Dean on January 26th, 2011 12:24 am? I was really close to starting a BOY, but Dean brought up the nagging questions I had.

Thanks

I have now posted my response to Dean. It took me awhile to complete it, since there were so many misconceptions in his post. I hope you’ll read it carefully, several times.

I also have a question for you, Marlene: What impact did the 50 + positive comments above have on you?

I noticed all the hype over dividend. In Insurance, a dividend is an overpayment of premiums. Your post on January 31st, 2009, “What the experts don’t know about Bank on Yourself policies, part 2” shows a dividend of $140,588 on a policy with a face amount of $250,000… meaning someone over paid their premiums by ~ $140k. Yet the Cash Value is ~$128k.

So the person over pays, yet their CV is less than the overpayment.

Calculate the actual cost of insurance and overall a terrible “investment”.

Better off putting all that extra money in tax free U.S. Treasury notes.

There’s no comparison between treasury notes and Bank On Yourself. Bank On Yourself has at least a dozen advantages and guarantees that treasury notes do not.

The thing that insurance companies do so well – that others should model – is that they consistently under-promise and over-deliver. For that reason, I have no problem with overpaying premiums. I also love the fact that the dividend grows exponentially meaning the growth curve steepens every year I hold the policy.

You never indicate that the insurance company is probably a mutual company and

could convert to a stock company.IF THIS HAPPENS how is your policy affected?

I have yet to see a hypothetical example showing numbers etc.why do you not

show this anywhere.Thanks

Kurt, one of the first policies I bought was from a mutual insurance company that converted to a stock company in the 90’s. I STILL receive dividends in the policy (that’s typical), plus I received stock in the company now worth almost $50,000, and which ALSO pays dividends.

So I’m not complaining!

But the companies preferred by the Bank On Yourself Authorized Advisors have achieved much of their growth from folks using this concept. And being a mutual company is part of that. They know they’d be shooting themselves in the foot if they converted to a stock company.

Today it has become obvious that there is no free lunch. People want a free lunch but there really is no free lunch. I will just take it at face value that you can do all that you say BOY can do. MY question is where does the money come from that makes all this possible? You say “… BOY concepts have riders incorporated into them that significantly increase the growth of the cash value.” You say “the value grows expodentially.”

Exactly how do you invest this money so that you can so readily pay it out as you describe? It sounds so good that the policy is written with this rider or that rider that so nicely benefits me so much greater than other ordinary whole life ins. Fine! The real answer to everyone’s question is to explain how it is that you have found the holy graile to investment return and can therefore do what no one else can do!!! If I buy one of your policies and it does all these wonderful things that no other policies can do, then you are making more money on my money than the other guy can make on my money! What are you doing?? Otherwise you are going to need a bailout or you will default somewhere down the line.

Hank, you will find the answer to your question here.

I’m in the process of getting a BOY policy and have come across one roadblock that reflects how conservative these insurance companies are. Two things I’ve learned:

1. The policies work well only if you have a standard or premium rating. I’ve been rated with a Smoker B rating and with that level your cash value doesn’t match your premiums for about 15 years. Not good.

2. Why am I rated Smoker B? Because of my incredibly incidental cannabis use. I even pointed out that I didn’t smoke it, but typically ate or vaporized it at a frequency of once every couple of months or so. Yet they barley approved me for a policy.

I’m very disappointed as my cannabis use is nowhere near as much a health risk as tobacco smoking or even moderate alcohol use, which apparently isn’t seen as a problem.

This is one huge roadblock for people like me trying to get a BOY policy.

Moderate alcohol-users live longer. However, tobacco smokers receive a huge rate-up. Cannabis (unfiltered) results in greater tar and carcinogen inhalation, aside from the political issue of illegality (federal law). These policies generally exclude benefits for death by illegal activity, so it’s a problem.

[…] It’s as if VISA or MasterCard were to declare, “Hey, we made a lot of money this year; let’s share our profits with cardholders.” Keep dreaming Note to Readers: The subject of insurance policy loans is often misunderstood by both financial advisors and consumers alike. I encourage you to learn the facts about policy loans and dividend-paying whole life in this lively and informative blog post I wrote. […]

Sounds great if you are insurable. This is a major problem for so many Baby Boomers who are arriving at a point in life where the chronic medical conditions have caught up with them (i.e. cardiovascular, diabetes, rheumotid arthritis, etc.) What if you have chronic or acute medical conditions that most insuers won’t touch? Sounds like this is dead in the water except for the relative few who have been totally free of any medical problems.

That’s one of the misconceptions people have about life insurance. You DON’T have to be the insured on the policy. Someone else can be the insured on the policy – typically a family member or business associate.

As long as you’re the owner of the policy, you control the policy and the money in the policy.

So don’t rule yourself out. A Bank On Yourself Authorized Advisor can help you look at your options. You can get a referral to one of the Advisors when you request your FREE, no-obligation Analysis.

WHERES ,..DAVE RAMSEY ,..Nowadays,..SUZE DID YOU RUN HIM ,..AWAY

I may have missed it, but what was the annual premium amount paid on the BOY policy used as an example? The one that began with $605,000 in death benefit. Thanks

$40,000 per year, the policy was back-dated 4 or 5 months.

I started a policy in May of 2011 at $18,000 per year. When renewal time came this year, $15,000 was all I could afford. Yesterday I checked my account values online and could not believe the amount of $$$ I could borrow was $24,000–in just over one year. I plan to use some of it to pay off a credit card. I will be the one to determine how much my monthly payment will be, how much the interest rate will be and how long the repayment period will be—not some financial institution. Nor will I be under the threat of repossession if I miss a payment or two or three. Because I can do these things, I WILL NOT have to eat beans–are you listening, Dave Ramsey?–to do it.

You’ve just confirmed what we’ve been saying for years! Suze Orman, Rave Ramsey and the other “gurus” have no clue how these policies work or how they’re different.

I’d love it if you’d share your story on our reviews page!

I listened to this over the radio on my way to work yesterday and I was curious if this is a life insurance policy?

Hi, Miriah.

Yes, it is dividend paying whole life insurance, but not the kind most financial advisors and experts talk about. You can learn exactly what Bank On Yourself is here.

Designed properly, it can give you peace-of-mind, guaranteed growth, safety, and more flexibility than any investment or savings program we’ve ever found. Compare them for yourself.

Hope this helps!

Hello Pamela,

I have 3 policies and they work just like you and your book say they do. I am very pleased with the benefits I’ve seen!

I have an unusual question though, resulting from a unique situation. I’m 53. Since I started the policies several years ago, my beneficiary situation has changed (from divorce, a death, no children, a newly well-off sibling, etc). In other words, although these policies are designed to minimize the death benefit, it’s still substantial, and I no longer have an obvious beneficiary.

Is there a way for me to take advantage of the death benefit while I’m still living? Access the funds in some way or at least minimize them further so I have nothing to leave? It would make a tremendous difference to my retirement if I could access the death benefit in some way (without getting a terminal illness first). If not, I’ll name friends and charities as beneficiaries. But it seems to me that this is an asset and maybe there’s a way for me to benefit from it now.

Thank you so much!

You’re right – this is an unusal question… and an excellent one!

You’ve probably noticed that your death benefit has increased since you started the policies – that’s how dividend-paying whole life insurance policies work, especially when they have the rider added that boosts the growth of your cash value.

However, once you start taking income from the policy in retirement, that pattern will eventually start to reverse and the death benefit will decrease.

If you knew what day you were going to die, you could probably draw all the policy values down to zero. But since you don’t know, I wouldn’t attempt to do this.

You are still young and even though you may not see another significant relationship in your future, you may well end up being pleasantly surprised.

And, unless that comes to pass, you can definitely name one or more deserving charities as your beneficiary.

In the meantime, it’s very important that you contact your advisor and seek advice about changing your beneficiary.

I just want to know if at 72 I’m too old to try this? I put my money in Mutual Funds 15 years ago & have lost much of it twice. I get a monthly income from the funds (Fidelity & Putnam), but every time they sell it I know they take a fee. My financial planner says he doesn’t take any, but I’m sure he does, or how else would he get his money! I also have a CD in the bank, which draws nothing in interest! How much would I have to have in it, to put it in Bank on Yourself? I have a couple autoimmune diseases, also. Would those affect my chances of getting into this? I don’t smoke or drink alcohol, but am a little overweight for my height. My doctor says I have no heart disease that she can detect, but I am very nervous. Would appreciate a short reply. Thanks!

It’s a good idea not to rule yourself out due to age or health. You still might qualify, and it’s not necessary for you to be the insured on your policy. What is important is that you own the policy, which puts you in control of the money in the policy. You could have someone else you have an “insurable interest” in be the insured, typically a family member or business associate.

You can learn more about how Bank On Yourself works for people between the ages of 80-85 on these two videos.

If you want to see what kind of results you could get with a plan like this custom-tailored to your situation, you can request a free, no-obligation analysis here.

Anyone trying to sell anything there is always pros and cons. Anyone not telling both sides of the pros and cons our hiding something. Book writers are selling their books, insurance co. are selling a policy. Remember after you retire it is very hard to recover loss money and many people have loss their whole life saving or found out too late the hidden facts because of being fraud or scammed by companies get rich off of their money. So, if you only hear all pros and NO CONS BEWARE. Everything in life has pros and cons. No cons – you are probably being taken for a free ride and won’t know until years later what the real truth is. Called read the fine print and everything you buy has small print. Know the legal terms before investing your money. A L W AY S

I do talk about the downsides of this concept:

1. It’s not a magic pill – it requires patience and discipline (which rules out many people right there). Your cash value won’t equal your premium in the early years.

2. If you borrow too much from your policy and don’t pay the loans back or at least the interest due on them, your policy could lapse with tax consequences.

3. There will be times when you’ll feel “left out” when other assets are skyrocketing… until the crash that inevitably follows, at which time you’ll thank your lucky stars for Bank On Yourself.

Saying that life insurance companies that are much more strictly regulated then banks and other financial institutions (and that have paid dividends every single year for more than 100 years) is out to con you is, well… if you’re looking for an excuse, that’s as good as any other.

Pamela,

Do you also mention that:

1) Dividends are not guaranteed – they may (and probably will) fluctuate over time and this could dramatically influence the growth of the policy)

2) Demutualization, while not a serious risk for all mutual companies, is still a risk to consider. Companies, like MetLife, who did demutualize, do pay dividends but, let’s be frank, it’s not as stellar as some of the mutuals. And, it’s been trending downward since 1990.

3) If you take a loan from the policy, the guarantees on policies may suddenly evaporate until the loan is repaid.

4) If you use term blending to achieve those high CVs, you’re foregoing the strong guarantees of a base-only policy. That doesn’t make the policy bad, but I think you should tell people this upfront.

5) PUARs can be awkward and inflexible if this is the primary method of creating excess cash in the policy, and every mutual company has its drawbacks and fine print concerning premium loads on PUAR premiums and how they can be made, as well as catch-up provisions if you need to skip a payment or temporarily reduce payments. Again, this is something I think needs to be stressed more. Life happens, people miss PUAR payments. They should know how this affects them over the short and long-term beforehand.

6) It is possible to lose money in the policy if you do not repay the loans and the interest charged exceeds the crediting rate. Hopefully this isn’t too much of a problem, if you’re educating clients on repayment of loans, but it can happen if you decide you need to “float” the loan for a year or two without making payments.

7) There is a *potential* risk of the “tragedy of the commons” developing within a company if there are enough policyholders taking out loans at once, and there isn’t really a great solution to this since too much cash in the GIA means lower performance for the policy. Too little means lowered liquidity. It’s basically the life insurance version of a “run on the bank.”

8) To expand on your point #1, it can easily take 7 years for the CV to equal the DB. So, if a person who is about to retire takes out a BOY policy, they may or may not be able to make *full* use of it for many years. That’s a very serious issue if the person does need money for income or expenses, or even emergencies. I know you mention this, but I don’t think it’s emphasized strongly enough.

I don’t necessarily disagree with some of the benefits you’ve come up with, but I also think you understate or minimize some of the risks. There’s risk in every financial product.

I read the book and it is very interesting. The book emphasizes that we will know the cash value of the whole life account upfront because the rates are guaranteed. Is that true or I am misinterpreting the information. How much are the typical rates?

You are correct – you do have a guaranteed annual cash value increase, so you know the minimum value of your policy at any point in time. On top of that, you have the potential to receive dividends, which have been paid every single year by the companies recommended by the Bank On Yourself Authorized Advisors. To find out what your specific bottom-line numbers and results could be, just request a free Analysis.