A balance sheet shows you at a glance what you own, what you owe, and what the difference is. The difference is your “net worth” – and the greater your net worth, the more you’re in a position to meet life’s financial uncertainties.

It’s called a balance sheet because your assets minus your liabilities always equals – balances – your net worth.

If you owe more than you own, your net worth is a negative number, and that’s an early indication of possible financial problems or bankruptcy in your future.

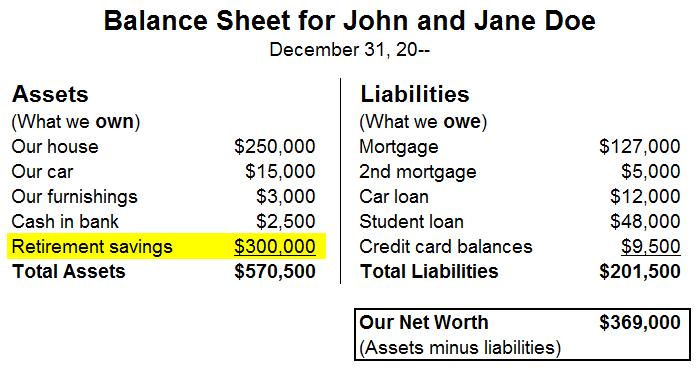

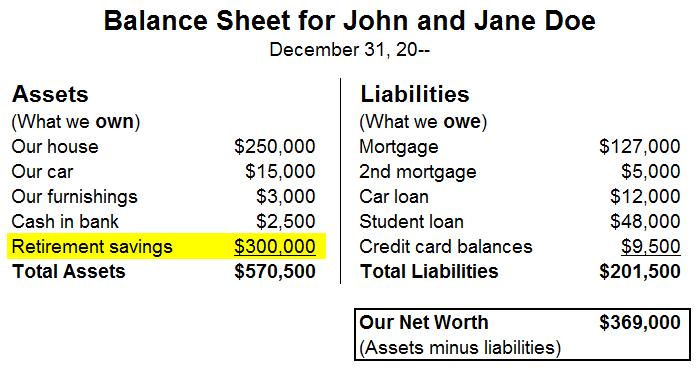

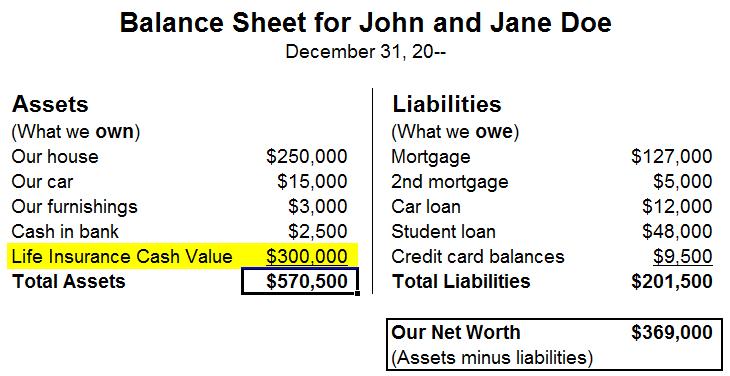

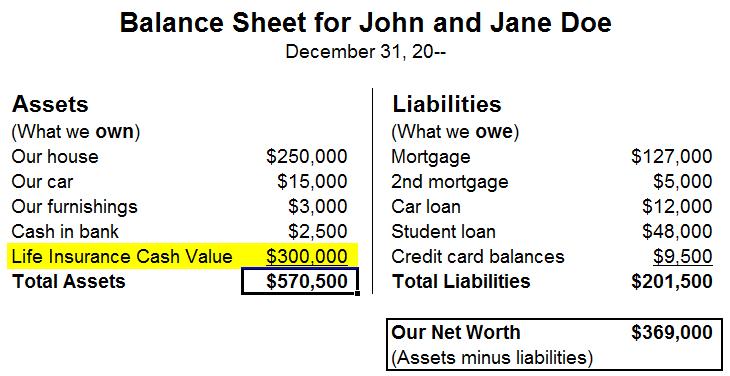

Here’s a simple balance sheet. See Figure 1. We see that John and Jane have added up the fair market value of their major possessions – their house, car, furnishings, cash in the bank, and retirement savings – and have total assets of $570,500. But when we subtract what they owe – their first and second mortgages, car loan, student loan, and credit card balances – their net worth (the cash they could come up with if they sold everything) is $369,000.

It’s called a balance sheet because your assets minus your liabilities always equals – balances – your net worth.

That’s the snapshot taken on December 31. A snapshot taken a month later could look different. The loan balances might be smaller. That would make John and Jane’s net worth a little larger.

Many personal finance software packages make creating a balance sheet quick and easy. Most financial planners will suggest you create a balance sheet at least once each year to track your progress toward financial independence.

Your personal balance sheet can tell you a lot, but it may not be telling you everything. When it comes to calculating the net worth of retirement accounts, your balance sheet can be extremely misleading – and not in your favor.

Get instant access to the FREE 18-page Special Report that reveals how super-charged dividend paying whole life insurance lets you bypass Wall Street, fire your banker, and take control of your financial future.

Why Your Personal Balance Sheet May Not Accurately Reflect Your Net Worth

Get instant access to the FREE 18-page Special Report that reveals how super-charged dividend paying whole life insurance lets you bypass Wall Street, fire your banker, and take control of your financial future.

Let me show you why having $300,000 cash value in a properly designed dividend-paying whole life insurance policy is much, much better than having $300,000 in a traditional IRA, 401(k) plan, 403(b) TSA plan, Thrift saving account, or 457 plan.

On your balance sheet, any of those traditional retirement accounts would be listed as an asset worth $300,000. Again, see Figure 1.

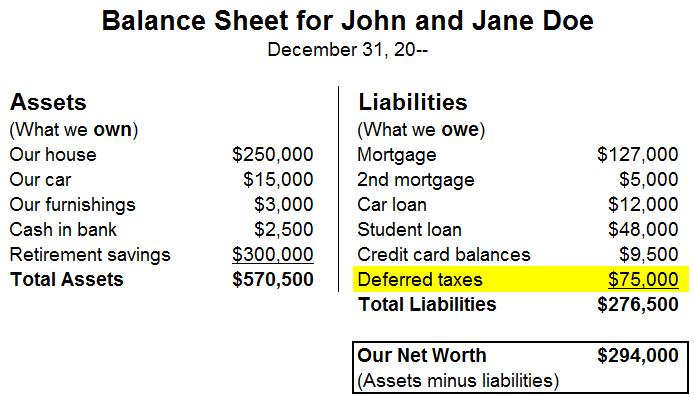

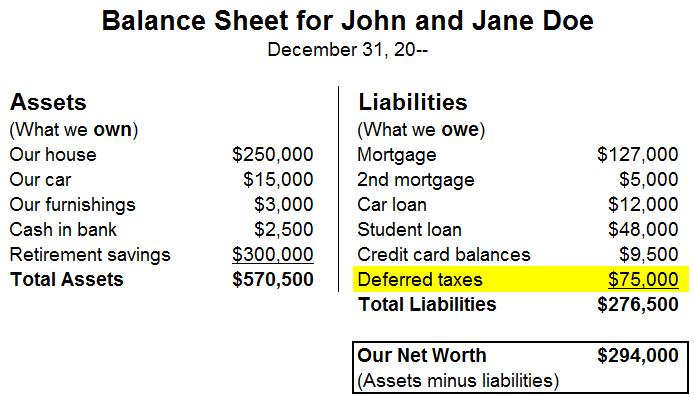

But all your traditional retirement accounts (except for Roth accounts) have a significant income tax liability lurking inside of them. You’ve deferred paying income tax on the money you used to fund those accounts, but you haven’t escaped paying the tax. You’ve just postponed it. And whenever you take money out of your traditional retirement account, you’ll owe income tax on every dollar you remove.

Remember that Uncle Sam is your partner!

It’s fair to say that whatever you have in your retirement account, you co-own with your Uncle Sam.

On the other hand, the equity (the cash value) of your whole life insurance policy is growing tax-deferred. And that growth is available to you in most cases income tax free, unlike the tax-deferred growth of an ordinary retirement account. In addition, all the cash value can be yours without the payment of income taxes (under current tax law). And when you die, the policy’s death benefit will be paid to your beneficiaries, again free of any income tax.

This balance sheet reflects the taxes you must pay your Uncle Sam as you withdraw your retirement savings. Don’t overlook those!

So how can you say the money in your retirement account, whose income tax liability has simply been postponed, is worth the same amount of money you’ve built up in the cash value of your whole life insurance policy?

You can’t. If you have $300,000 in traditional retirement accounts – and if you want your balance sheet to be accurate – your balance sheet needs to have another item on the liability (“What I Owe”) side, called Deferred Income Taxes. If you’re in the 25% tax bracket, that liability is $75,000. See Figure 2.

This balance sheet reflects the taxes you must pay your Uncle Sam as you withdraw your retirement savings. Don’t overlook those!

Deferred Taxes Can Reduce the Net Worth Shown on Your Balance Sheet

What does that $75,000 liability do for John and Jane’s net worth? It reduces their net worth by $75,000.

To keep things simple, let’s say you’re in the 25% tax bracket. That means that you owe 25% of the value of your $300,000 retirement plan to Uncle Sam. Uncle Sam gets $75,000. You only get $225,000.

But if the $300,000 were the cash value of a whole life insurance policy, not a traditional retirement plan, you could typically get your hands on the cash income tax-free, under current tax law.

Your Favorite Uncle gets $0.00, and you get the entire $300,000. Which would you rather have?

Your Family May Get Stuck Paying Some or All of Your Deferred Taxes

If you die before you’ve withdrawn all the money from your traditional retirement account, what’s left will go to your beneficiaries – and Uncle Sam will look to them to pay the income tax you owe. In addition, your family may have to pay estate tax on your retirement money they inherit.

Your Life Insurance Cash Value Increases the Net Worth Shown on Your Balance Sheet

What if you had a Bank On Yourself-type cash value whole life insurance policy? Well, first, you wouldn’t have that liability called Deferred Income Taxes, because there aren’t any!

Second, you’d have a cash value that is an asset (something you own). In this example, your cash value is $300,000.

This balance sheet reflects the value of your life insurance policy cash value as an asset.

To make your balance sheet more accurate, you need to add an item to the asset (“What I Own“) side, called Life Insurance Cash Value. See Figure 4.

Now compare Figure 1 with Figure 4. The numbers on both balance sheets are identical. Figure 1 shows your retirement savings of $300,000, while Figure 4 shows your life insurance cash value of $300,000.

But remember, we showed earlier how Figure 1 shows an incomplete snapshot of your liabilities – what you owe – because it doesn’t include the taxes you’re going to have to pay on your retirement savings as you draw the money out of your account.

Figure 2 shows the whole picture, including both your retirement savings and the taxes due.

And Figure 4 is a much better-looking balance sheet than Figure 2, because with life insurance, you can arrange your cash value withdrawals so there is no income tax due, under current law.

This balance sheet reflects the value of your life insurance policy cash value as an asset.

Get instant access to the FREE 18-page Special Report that reveals how super-charged dividend paying whole life insurance lets you bypass Wall Street, fire your banker, and take control of your financial future.

When your family inherits your traditional retirement account, they’ll owe taxes on the money

And it should go without saying that when you pass away and your family inherits what’s left in your retirement account, they’ll have to pay income tax on the money. But if you have a life insurance policy, your beneficiary will receive the death benefit of the policy – which could conceivably be three or more times greater than the cash value – with no income taxes due, under current law!

Without updating your balance sheet – by adding a deferred tax liability if you have traditional retirement plans, and by adding a life insurance cash value asset if you have cash value life insurance – your balance sheet simply isn’t giving you the whole picture.

Bank On Yourself-type life insurance policies don’t have hidden taxes to lower your net worth. They do have cash value that raises your net worth! To learn more about Bank On Yourself, get our Free Special Report, 5 Simple Steps to Bypass Wall Street, Beat the Banks at Their Own Game and Take Control of Your Financial Future. See how you can improve your balance sheet with Bank On Yourself!

Get instant access to the FREE 18-page Special Report that reveals how super-charged dividend paying whole life insurance lets you bypass Wall Street, fire your banker, and take control of your financial future.

A Third Problem with Your Balance Sheet: Your Assets – Even Your Retirement Account Values – Are Only Estimates

Your balance sheet shows the estimated worth of your assets if you could sell them today at fair market value. Your balance sheet does not tell you what they would be worth if the market tanks, or even if it soars. It can’t! It’s not a prophet – even if it does help you determine your “profit”!

For that reason, take your balance sheet with a BIG grain of salt. We’ve had two market drops of 50% or more since 2000. Could it happen again? I’m not a prophet either. But I certainly wouldn’t bet against it.

The Right Kind of Life Insurance Policy Can Make Many of These Tax Issues Go Away

Bank On Yourself-type life insurance policies are high cash value whole life insurance policies, which give you significantly greater cash value, particularly in the early years, than traditional whole life insurance policies – without losing any of the tax advantages.

You’ll sleep better at night with assets that are guaranteed – like the high cash value life insurance policies preferred by Bank On Yourself Professionals. Using the Bank On Yourself strategy, you can know what the minimum guaranteed cash value of your policy will be on the day you retire, and at any point along the way.

To find out more, request a FREE, no-obligation Analysis. You’ll receive a referral to a Professional (a life insurance agent with advanced training on this concept) who will show you more reasons why adding a Bank On Yourself-type life insurance policy to your retirement strategy may be a very good idea.

Speak Your Mind