When we released our Stock Market Survey a few weeks back, we were surprised so many readers responded. We were even more surprised by the results of the Survey, which we promised to share with you, so read on…

Nearly half (45%) of those who took the survey said, “I don’t trust the market with money I can’t afford to lose.” They clearly understand that the money they’re setting aside for something as important as retirement or a college education is money you really can’t afford to lose.

Fully 45% of our subscribers believe a major market crash – a plunge of 50% or more, as we had in 2000 and again in 2008 – is imminent. And another 34% expect that calamity to happen in the next 3-5 years.

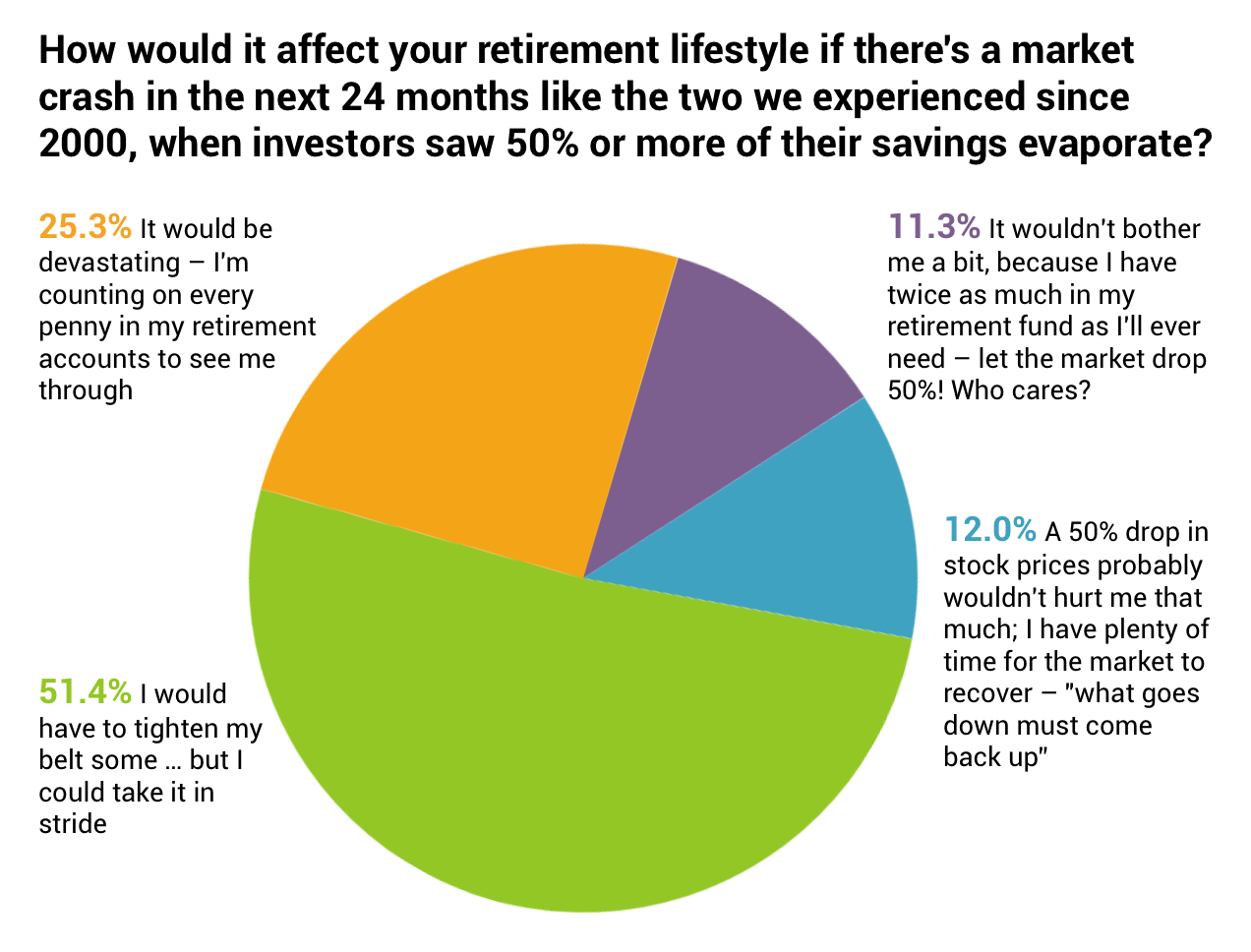

But when we brought the situation closer to home and asked readers how a severe market crash would affect them personally, we found wave after wave of denial.

About 12% said that even if the market drops by 50%, “I have plenty of time to recover.” I suspect these folks don’t realize that since 1929, we’ve had three market crashes where the Dow took between 16 to 25 years to recover. What if history repeats itself?

And perhaps the biggest indicator of fingers-in-ears yelling, “I can’t hear you! I can’t hear you!” is the admission by more than half of our respondents that, if the bottom falls out of the market, “I’d have to tighten my belt some, but I could take it in stride.”

What? A Loss of Half of Your Retirement Savings and You’d Just Tighten Your Belt “a Little”?

If you only have half of what you’d planned to have, you can only spend half of what you’d planned to spend. Better make a note to yourself to…

- Find a decent place to live for half what you’re paying now

- Line up a good source for half-price food and half-price utilities

- And settle for cut-rate medical care

No, it’s not going to be that easy to “take it in stride.” People suffer when the market crashes. Many lose their homes. Unable to pay for utilities, some literally freeze to death in the winter and die from heat exhaustion in the summer.

And some are forced to choose between buying the food they need to survive and the medicine they need to keep from dying.

Still, almost half our respondents are so optimistic they say that if they lost 50% of what they had, they’d still take as much risk – or more! – with whatever they have left.

That’s How Successful Wall Street Has Been in Brainwashing Us to Believe We Must Risk Our Money in Order to Grow It

The fact is that the number of suicides goes up when there’s a severe market crash. Business Insider reported that “foreclosures, substance abuse, family battles and – worst of all – widespread depression reached startling proportions” in the years after the 2008 market crash.

The behavioral finance experts note that we humans have a remarkable ability to forget the pain of the past and remember only the good times.

But Those Who Forget History Are Condemned to Repeat It

As a recent article on Bloomberg noted…

“Washington is in gridlock and the White House faces scrutiny. Valuations are the highest since the financial crisis. … The Volatility Index is at a 24-year low.”

And what goes up always comes down – too often with a loud and life-shattering thud.

Yep – We’re Livin’ in the Good Ole United States of Amnesia…

What if there were a better way to save for retirement than trusting your life savings – and possibly even your life – to the Wall Street Casino? (There is a better way.) What if you were too brainwashed, too cynical, or too lazy to even check it out? (You’re not, are you?)

To learn how you can grow your nest-egg safely, and with guaranteed growth – that’s guaranteed to grow by a larger dollar amount every year… and that’s never had a losing year in more than 160 years – just request a free, no-obligation Bank On Yourself Analysis here, if you haven’t already.

You’ll get a referral to one of only 200 Professionals who have met the rigorous training and requirements. They’ll answer your questions, show you ways to restructure your finances to fund your plan, and design a Personalized Solution and Recommendations custom tailored to your unique situation.

Then you can sleep like a baby when the next crash happens – the crash you know in your heart is coming.

Speak Your Mind